Southwest Companion Pass For One Year + 30,000 points – Very Easy

This offer expires March 11, 2024. So, get in there!

For the third February in a row, Southwest has rolled out a VERY EASY way...

2023 Year-End To-Do List!

It’s crunch time. We’ve got a few days to take care of things before 2023 turns into a pumpkin.

Refill Prescriptions & Exhaust Health Savings...

It’s “Giving Tuesday”

We have Black Friday, Small Business Saturday, Lazy Sunday, Cyber Monday and Giving Tuesday.

Being charitable is a good thing - especially if it will get...

Where to Find The Best Savings Rates

Two people gave me hives this week! They told me how miniscule, dare I say puny their interest was on their savings. I broke...

75,000 Southwest Bonus Points

This is the time of year when credit card bonuses balloon. That’s because the card companies know people spend a lot during the holidays....

How To Get NFL Sunday Ticket

You can't get NFL Sunday Ticket free anymore, but there is one severe discount that might work for you: The Student Discount Plan. If...

Two Deals for Spectrum Cable or Internet Subscribers

Deal #1:

Last week, 19 Disney-owned channels and seven ABC stations were yanked off Spectrum Cable. The Mouse couldn't come to terms with Spectrum. Therefore,...

Last Day to File Facebook Claim

If you got your Facebook on in the USA between 2007 and 2022, today's the last day to claim money from the settlement.

You know...

My Interview with U.S. News & World Report

When I was five years old, sitting in the lobby of my doctor’s office, I was introduced to U.S. News & World Report. My...

Southwest Made It Rain!!

I was one of the thousands of folks who had their Southwest Airlines flights cancelled while I was over the river and through the...

AutoSlash For Best Rental Car Rates

I have been a huge fan of AutoSlash for over a decade. If you need a rental car during the Holidays, listen to this!

Why...

Hear My Jibber Jabber on the “Call Me Curious” Podcast (Link Below)

Listen to my chat with Nikki Boyer and Mr. Malone on their Wondery "Call Me Curious" podcast. We had fun discussing how I collect...

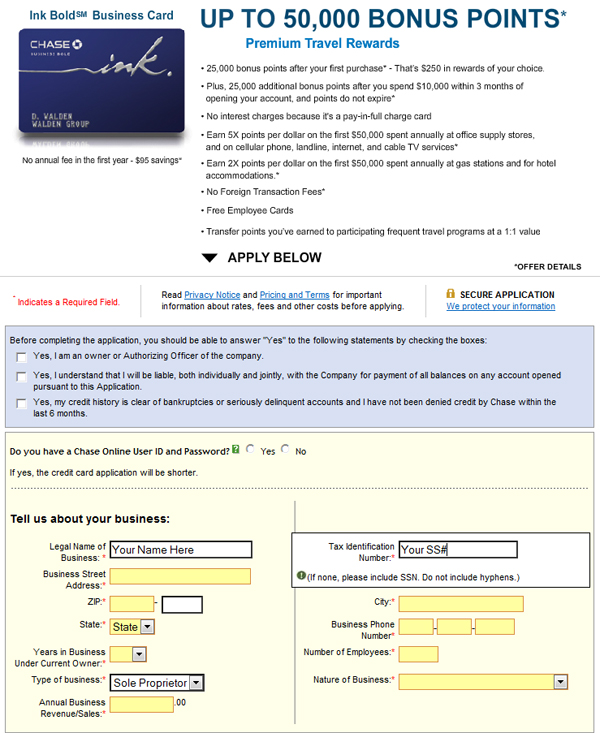

How To Get a 0% Balance Transfer Card

Have you loaded your credit card to its limit? Has your card been swiped so much the stripe on the back is hot to...

Should You Have A Storage Unit?

If you are like me - on a Spring Cleaning jag - don't forget your storage shed! Do you really need it? You may...

Is This Missing Money Yours?

Wanna have fun? Go on a Missing Money Treasure Hunt Bender! Every year, I search the Unclaimed Funds sites for cash that never got to...

Put $ In Your IRA… But Don’t Buy Anything. What The?

Someone once said, "The stock market is like a crying baby that wants to be soothed." If there is unusual upheaval in the world,...

GEEZER ALERTS

Mother May I… Avoid Probate – Part II – Electric Boogaloo

> States that allow TOD on vehicles

> Securities and Exchange Commission - Regarding Transfer On Death (TOD) Registration

> Probate Shortcuts - By State or...