> Securities and Exchange Commission – Regarding Transfer On Death (TOD) Registration

> Probate Shortcuts – By State or click here, choose your state, click Probate Shortcuts

> Allowable Probate Fees – California

> Allowable Probate Fees – Ohio

> Use a Revocable Living Trust to Avoid Repeating Probate in Several States

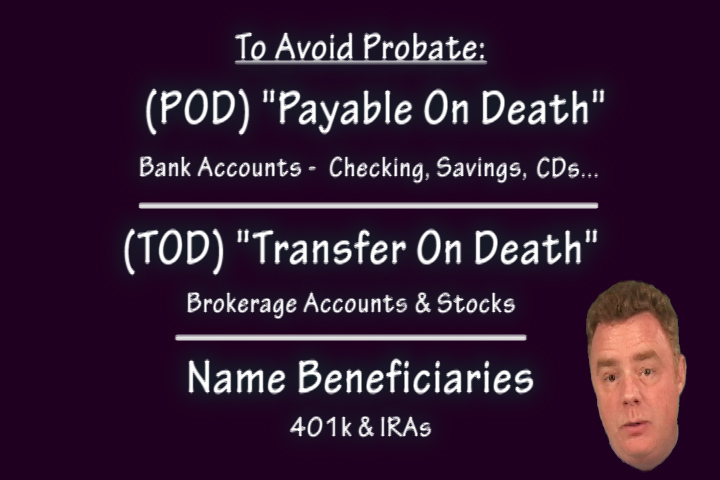

> Avoid Probate with Payable On Death (POD)

Video Transcript:

Hey, welcome to Chips Money Tips. I’m Chip Chinery. This tip could save you thousands of dollars. It is free, and easy to do, and it should take only a few minutes.

This topic gets a Geezer Alert because they are the ones who are most likely to suffer from not knowing about this – which in turn will make YOU suffer. We must look out for the geezers in our lives: our parents, grandparents, aunts and uncles. This will save them money, but it will also save your inheritance. Real talk. And gravitas.

Generally speaking, when someone dies what they leave behind goes through Probate court… Whoa. Whoa! Whoa!! Don’t fall asleep on me. That always happens. Mere mention of the P- word and your eyes start to glaze over. Anyway, (mouth it) Probate is lengthy and expensive. “Probate Costs” may be a couple hundred bucks, and “Probate Fees” can run over $100,000.

This is right about where people say, “I don’t have to worry about that, ChipsMoneyTips, because I have a Will.” Well, it’s good that you have a Will, but all a Will does, regarding your “stuff” is tell those left behind who gets what stuff.” And “that stuff” is also subject to appraisal and Probate Fees.

Here’s how it works: let’s say Joe Blow has died. His estate, “The Joe Blow Estate” must go through what is called “Probate” court, where all of Joe Blow’s money, stocks, and property – known as “assets” and all of his debts – or liabilities”, get figured out.

The Joe Blow Estate will be represented in Probate court by an “Executor”, who is often a family member or someone else who Joe has named. Other times, the family will hire an attorney to do it, or the Probate court will appoint someone. And this is where the cost comes in, because that lawyer or court appointed person charges Joe’s Estate an hourly fee based upon the value of The Joe Blow Estate.

For example, let’s say Joe died owing $5,000 on credit cards and other bills, and had $225,000 in assets – checking account, savings account, CDs stocks, Hello Kitty figurines, Probate makes sure Joe’s bills get paid out of that money. That’s fine. But, in my opinion, the additional associated Probate fees people are allowed collect are out of line for the work done. These Probate Costs & Fees vary from state to state. InCalifornia, the Joe Blow Estate could be charged as much as seventy-eight hundred bucks. But that’s crazy California. In Ohio it’d be ninety-six hundred bucks! You can Google Probate Costs and Probate Fees for your state – if you still need some motivation. If you are watching this at ChipsMoneyTips.com, there are reference links below this video to support my facts and figures.

These “Probate Fees” are negotiable, but a lot of people don’t know that. So when Probate Court appoints someone at the “standard approved fee,” the family members say “Great. Handle it,” And the family ends up losing a lot of money.

But all that can be completely and legally avoided – for free, and I think you will agree that your friends, your relatives, and you would rather have ALL of your money left to the people or charities you choose, rather than have ANY of it go to some court appointed stranger you’ve never met. Especially, when it only takes a few minutes to make sure that happens.

In the next video “Mother May I Avoid Probate – Part 2 – Electric Boogaloo”, which you can check out right up here, I will explain how to do this quickly and easily using real numbers and a personal scenario, and of course, lots o’ lots o’ gravitas.

This is not legal advice. Consult an attorney before acting.