Dying is something you don’t think about when you are young, and you avoid thinking about when you are old. As Jim Morrison said, “No one here gets out alive.”

Dying is something you don’t think about when you are young, and you avoid thinking about when you are old. As Jim Morrison said, “No one here gets out alive.”

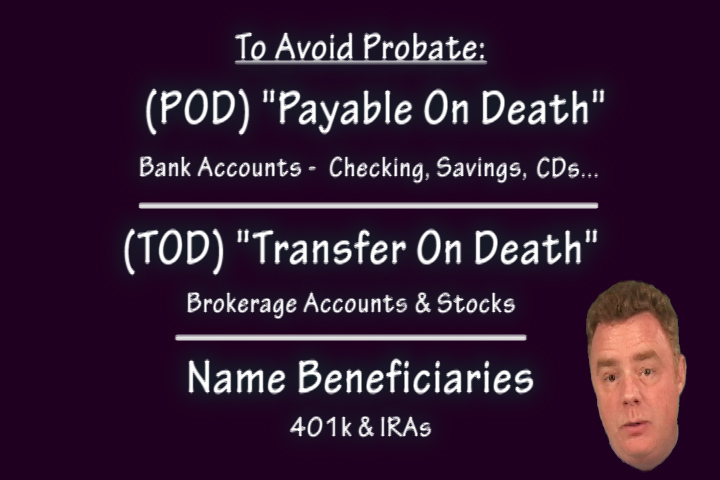

It’s been almost two years since I talked about Trusts, Wills, POAs, POD & TOD, and avoiding Probate. Yes, these are things grown-ups should address.

Even more pressing, you should make sure that the geezers in your life have these ducks in a row. Following through can save you headaches, frustration, and thousands of dollars.

This is one of the first Chip’s Money Tips videos I did a few years ago. It’s about Avoiding Probate. Stay tuned. I’ll cover the other topics this week.

> Probate Shortcuts – By State or click here, choose your state, click Probate Shortcuts

> Allowable Probate Fees – California

> Allowable Probate Fees – Ohio

> Use a Revocable Living Trust to Avoid Repeating Probate in Several States

> LegalZoom & Nolo can help

Hey Chip,

Gracias for all the Gravitas!

FYI, I called my bank (a certain institution with the initials WF who is fond of horses and shall remain nameless) and they refused to designate PODs over the phone – “I’m sorry sir you will have to come in to the branch to make that transaction”. My next call will be to the online bank where most of my cash is held. My guess is they will make the change for me, or at least be willing to email me the forms.

So, poor service and a laughable interest rate on my savings – if it weren’t for that all important “member since 1987” designation I don’t think I would stay with WF.

Also FYI for your readers, retirement accounts (IRAs, 401k, 403b…) have default beneficiaries which are based on federal law, state law or the documents that govern the particular account. As such there is no TOD designation to be made since the beneficiaries will have direct access to the account (i.e. no probate),

In CA (and other community property states) the spouse is designated as the primary beneficiary. In fact, CA and many other states require you to get notarized approval from your spouse if you want to change that primary designation.

If your spouse kicks the bucket before you (oh excuse me, passes away – RIP), the default beneficiaries would generally follow as such – children, grandchildren and then your estate. So, if you want to leave your IRA to your cat or you are unmarried and have no kids or grandkids, make sure to name specific beneficiaries to avoid probate. If you are a regular Joe with a wife and kids, the default may be just fine. You should, however, make a call to ensure that your particular account has the proper default.

Here’s an interesting twist, what if you and your spouse die at the same time (in a car crash for example). No problem, the account would just go to the kids, right? True, the default succession would have your kids next in line. But what if this is a second marriage and you and your wife each have kids from a previous marriage. Here’s where it gets tricky.

In this case the court will actually make a determination of who died first (can you say forensic expert). If it’s found that your wife died first, you’re ok and your kids will get everything. But, if you died first, the account would pass to your wife (in the millisecond that took place after you kicked and before she died) and her brats would get all the loot.

So, if you are a Brady Bunch family and you really never liked Marsha anyway, you are better off designating specific beneficiaries for your retirement accounts and not relying on the defaults. If you don’t hold your retirement accounts with WF you may even be able to get some customer service with this issue.