Carrie wrote: “Six weeks ago, I got the Chase Ink card that you recommended for Festivus. I met my spending requirement and got my 50,000 point bonus – which I redeemed for $500! Momma needs a new pair of (expensive) shoes!! I plan to use the Ink card for at least the no-annual-fee first year. If I decide to cancel the card at some point, what happens to my unused Ultimate Rewards Points?”

Carrie wrote: “Six weeks ago, I got the Chase Ink card that you recommended for Festivus. I met my spending requirement and got my 50,000 point bonus – which I redeemed for $500! Momma needs a new pair of (expensive) shoes!! I plan to use the Ink card for at least the no-annual-fee first year. If I decide to cancel the card at some point, what happens to my unused Ultimate Rewards Points?”

Carrie, in times like this, I like to quote The A-Team’s Hannibal Smith: I love it when a plan comes together! Chase’s generous card bonuses are legit. Like you – I’ve done them as have gajillions of others.

About your points… If you cancel your card, the unused points go bye-bye – BUT it’s easy to keep them off death row. You can dump those points to another card that gives Chase Ultimate Rewards points. You may combine points between your own accounts as well as those of your spouse or domestic partner. This is EASY!

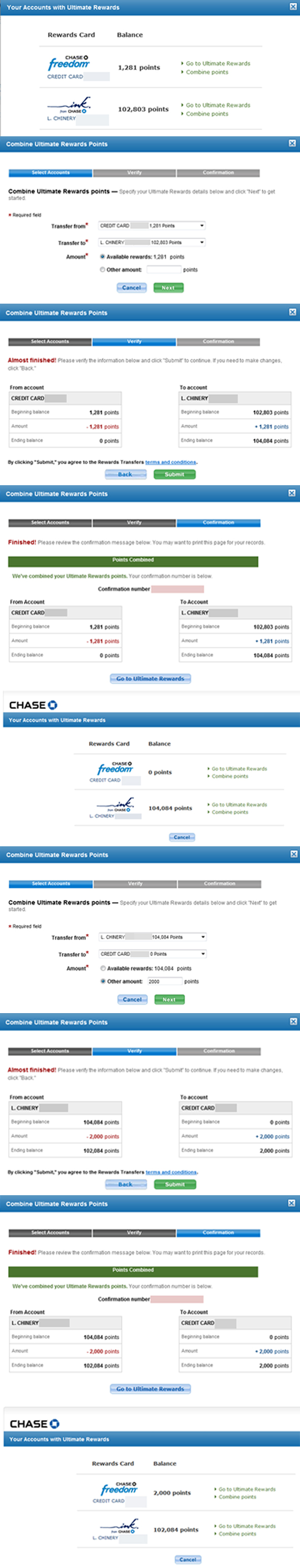

In the screen captures below, you can see how I moved points from my Chase Freedom to my Chase Ink Bold and back to Chase Freedom – instantly.

If you are thinking about ditching one of your Ultimate Rewards cards before the annual fee hits, I highly recommend you get the Chase Freedom card. It never has an annual fee. Then you never have to worry about your Ultimate Rewards points croaking. I use it for this purpose, as well as getting me 5% cash back throughout the year.

Right now, if you get a Chase Freedom Visa or Chase Freedom MasterCard you will get $100 worth of Ultimate Rewards points (10,000) if you spend $500 on it in the first three months.

The fine print about transferring Ultimate Rewards points:

Transfers may only be used to combine points/rebates belonging to the same individual or business in the Program; or for the purpose of enabling spouses or domestic partners to combine points/rebates earned in their respective names.

Here’s a list of Chase cards that earn Ultimate Rewards points. If you apply for the Ink cards as a Sole-Proprietor, use your name as the business name, your social as the Tax ID number. Very easy, legal and legitimate.

Click on “Chip’s Favorite Credit Card Offers” at the top right side of this website for up-to-date deals, terms, and conditions on these cards and more. Email me if you have any questions about which card might be right for your situation.

- Chase Ink Bold® Business Card – 50,000 bonus points after you spend $5,000 in the first 3 months. $95 annual fee waived first year. No Foreign Transaction Fees.

- Chase Ink Classic® Business Card – 20,000 bonus points after you spend $3,000 in 3 months from account opening. No annual fee.

- Chase Ink Cash® Business Card – 20,000 bonus points after you spend $3,000 in 3 months from account opening. No annual fee.

- Chase Ink Plus® Business Card – 50,000 bonus points after you spend $5,000 in 3 months from account opening. $95 annual fee waived first year. No Foreign Transaction Fees.

- Chase Freedom® Visa Card – $100 bonus cash back (10,000 bonus points) after you make $500 in purchases in your first 3 months from account opening. No annual fee.

- Chase Freedom® MasterCard – $100 bonus cash back (10,000 bonus points) after you make $500 in purchases in your first 3 months from account opening. No annual fee.

- Chase Sapphire® Card – 10,000 bonus points after you spend $500 in the first 3 months. No annual fee.

- Chase Sapphire Preferred® Card – 40,000 bonus points when you spend $3,000 in 3 months from account opening. $95 annual fee waived first year. No Foreign Transaction Fees.

Thank you for clicking on Chip’s Favorite Credit Card Offers for up-to-date deals, terms, and conditions on these cards and more. I appreciate it! Not only will that ensure you get the correct offer, but we may get a referral credit from approvals. That support helps keep the 1s and 0s spinning around cyberspace bringing great Chip’s Money Tips to you!! Many graciases. Email me if you have any questions about which card might be right for your situation.