My bromance with my Ink Bold card has never been stronger. Its terms were tweaked on 11/13/12, but I’m still smitten. Click on “Chip’s Favorite Credit Card Offers” at the top right side of this website for up-to-date deals, terms, and conditions on this card and more. Email me if you have any questions about which card might be right for your situation.

My bromance with my Ink Bold card has never been stronger. Its terms were tweaked on 11/13/12, but I’m still smitten. Click on “Chip’s Favorite Credit Card Offers” at the top right side of this website for up-to-date deals, terms, and conditions on this card and more. Email me if you have any questions about which card might be right for your situation.

Now it is twice as easy to get 50,000 Ultimate Rewards points worth $500 in cash or $625 in travel. The old promotion of getting 25,000 points for making one purchase has left the building.

Why should you get this one? Like I said in the original post, it’s only a few weeks until Christmas, Hannukah… Festivus. Which means you could probably use some extra cash. Here’s how you can actually get $500 tax free by Christmas.

Why should you get this one? Like I said in the original post, it’s only a few weeks until Christmas, Hannukah… Festivus. Which means you could probably use some extra cash. Here’s how you can actually get $500 tax free by Christmas.

1. Apply for an Ink Bold® Business Card.

“Business” – What the??? I’ll explain later.

2. Spend $5,000 in the first 3 months from account opening.

“$5,000 – What the???” Here’s an easy way to help achieve that.

You will earn points worth $500.00 cash or $625 in travel. When your statement drops, your points show up (like mine did) and you can have them send you a check. Apply now, and you could be loading up on top shelf egg nog.

My real life example: I got my Ink Bold card on October 9th. I made purchases. On October 17th, my statement dropped and my points showed up in my account. I saw this all online in my card’s account at Chase. I could have had them shoot me a check if I wanted, but I decided to leave the points there for now.

My real life example: I got my Ink Bold card on October 9th. I made purchases. On October 17th, my statement dropped and my points showed up in my account. I saw this all online in my card’s account at Chase. I could have had them shoot me a check if I wanted, but I decided to leave the points there for now.

The card has other perks including:

- Free Lounge Club membership

- No Foreign exchange fees – a huge money saver for globetrotters

- No interest charges – because it is a pay-in-full charge card

- No annual fee for a year – so try it out and see if you like it

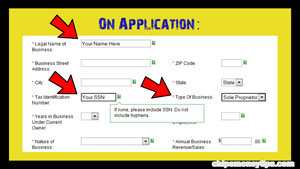

It’s a “business” card, but that doesn’t really mean much since you don’t have to have a corporation or LLC to get this card. If you just said, “A what?” Don’t worry about it. You’ll apply as a “sole proprietor”.

It’s a “business” card, but that doesn’t really mean much since you don’t have to have a corporation or LLC to get this card. If you just said, “A what?” Don’t worry about it. You’ll apply as a “sole proprietor”.

Cuz, if you make money doing stuff – you are a “sole proprietor”. Are you a Handyman, actor, dog walker, nanny, seller of stuff on ebay – congrats you are all sole proprietors!

In the application, for “Type of Business” choose “Sole Proprietor”. Put Your name as the business name and Your Social Security number where it asks for Tax ID.

In the application, for “Type of Business” choose “Sole Proprietor”. Put Your name as the business name and Your Social Security number where it asks for Tax ID.

First, you must apply. Click here to make sure you get the right offer. Think about it. If you and your significant other do this – you’ll be loaded!

- If you get denied or want an answer after you apply, call the Reconsideration Line (800) 453-9719

- The IRS definition of a Sole Proprietor

- Will your credit score drop if you apply for new credit? FICO says, “If it does, it probably won’t drop much.”

Thank you for clicking on “Chip’s Favorite Credit Card Offers” at the top right side of this website for up-to-date deals, terms, and conditions on these cards and more. I appreciate it! Not only will that ensure you get the correct offer, but we may get a referral credit from approvals. That support helps keep the 1s and 0s spinning around cyberspace bringing great Chip’s Money Tips to you!! Many graciases. Email me if you have any questions about which card might be right for your situation.