They keep sweetening the deal to get my dead dad to sign up for a United MileagePlus Explorer card. Well, it is a generous offer – but he’s not doing any more flying.

They keep sweetening the deal to get my dead dad to sign up for a United MileagePlus Explorer card. Well, it is a generous offer – but he’s not doing any more flying.

These card offers come because he didn’t Opt-Out of them. How could he? He doesn’t have wi-fi at his current locale six feet under. To avoid the temptation to accept their sweet offer on his behalf (and commit fraud), I opted-out for him at OptOutPrescreen.com. You can do this Dead or Alive.

There are pros and cons to this. If you Opt-Out, you will get less junk mail. Then you can find out what the best offers are if you click on “Chip’s Favorite Credit Card Offers” at the top right side of this website for up-to-date deals, terms and conditions, and more. Woo-hoo! All right! Yea Chip’s Money Tips!

But don’t Opt-Out so fast! Junk mail has a silver lining. If you Opt-In to mailings – you can get “targeted offers”. Those can be better than what are currently available to the general public.

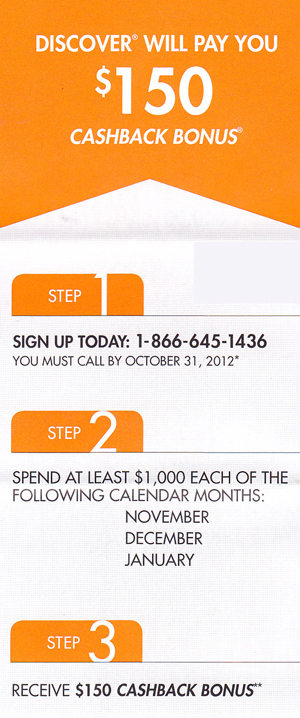

For example, I just got a targeted promotion from Discover. I already have the Discover More card. This targeted offer will give me $150 cash back if I spend at least $1,000 on the card in November, December and January. Applying a little 2nd grade math, I know that is a 5% cash back bonus.

For example, I just got a targeted promotion from Discover. I already have the Discover More card. This targeted offer will give me $150 cash back if I spend at least $1,000 on the card in November, December and January. Applying a little 2nd grade math, I know that is a 5% cash back bonus.

I confirmed with Discover that this targeted bonus is in addition to the regular cash back that this card gives me. Discover’s 5% cash back categories for this quarter are Department Stores and All Online Shopping. Holy Cyber-Monday, Batman!

I met the targeted spending requirement for November by using my Discover card for a combination of online Christmas shopping and year-end charitable contributions. I’d do more of the same in December, and may polish off the final $1,000 in January by using payUSAtax.com to pay quarterly estimated taxes. I like to meet spending requirements in one fell swoop.

One man’s junk mail is another man’s treasure.

Thank you for clicking on “Chip’s Favorite Credit Card Offers” at the top right side of this website for up-to-date deals, terms, and conditions on these cards and more. I appreciate it! Not only will that ensure you get the correct offer, but we may get a referral credit from approvals. That support helps keep the 1s and 0s spinning around cyberspace bringing great Chip’s Money Tips to you!! Many graciases. Email me if you have any questions about which card might be right for your situation.

dude, love the site. i’ve been playing the airline/hotel credit card game for a few years now – i love not paying hotel fare (or the taxes!) because i made one purchase and got 30-40K points…

Anyway, have you seen the US Air card? 30K points for 1 use, then 10K points for a balance transfer of at least $100 (there will be a $10 charge for a $100 transfer). Their award-tickets start a 20K points! 2 Free airline tickets for $10? Hell yes!

Thanks i love the site, have been finding even more deals through you. I found you thru Mike Schmidt.

Thanks Bob. Here’s the US Air card. It’s over in my Credit Card Search Engine – which can also be found by clicking on the orange button labeled “Chip’s Favorite Credit Cards” on the front page of the site. You can look at my favorite cards, airline cards, hotel cards and more!