When I get excited about a sweet deal, I can’t stop prattling about it. The combo of Bluebird and Ink Bold has me babbling something fierce. I’m like Daffy Duck at the end of cartoon, zig-zagging off into the sunset.

When I get excited about a sweet deal, I can’t stop prattling about it. The combo of Bluebird and Ink Bold has me babbling something fierce. I’m like Daffy Duck at the end of cartoon, zig-zagging off into the sunset.

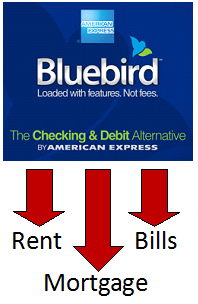

In short, now it is possible for you to get 5% back on EVERY bill you pay (including rent, mortgage, property taxes) while eliminating monthly banking fees. That’s $50 back for every thousand paid.

Bluebird gives you everything a checking account does – but without fees. It used to be only tax cheats, illegal aliens (and regular aliens) didn’t have bank accounts. Now that banks are making it more difficult to have free accounts, people are looking for less expensive alternatives.

Why do Bluebird? Maybe you are like me and already have free checking with all the bells and whistles, and never pay bank fees. Well, gather ’round the screen and I’ll tell ya why you should consider it. This is where it gets GOOD!

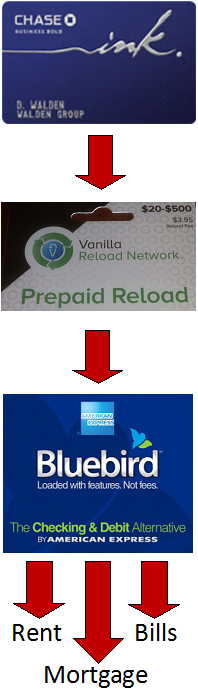

You can load up your Bluebird account in many ways, including funding it with Vanilla Reload cards. You can buy those at Office Depot. If you use your Chase Ink Bold card, you get 5 points for every dollar spent at office supply stores. I’ll rewind that, and take it from the beginning, slowly.

Apply for a Chase Ink Bold card. With Chase Ink Bold you earn 5x the points on purchases at office supply stores like Office Depot. They sell something called Vanilla Reload cards. They are $3.95 charge per $500 reload card. If you use your Ink Bold card to buy a couple $500 Vanilla Reload cards, you will have $1,000 to use and get 5,040 Ultimate Rewards points (worth $50.40 cash or $63.00 in travel).

Apply for a Chase Ink Bold card. With Chase Ink Bold you earn 5x the points on purchases at office supply stores like Office Depot. They sell something called Vanilla Reload cards. They are $3.95 charge per $500 reload card. If you use your Ink Bold card to buy a couple $500 Vanilla Reload cards, you will have $1,000 to use and get 5,040 Ultimate Rewards points (worth $50.40 cash or $63.00 in travel).

Pop onto VanillaReload.com and see the pretty lady on the landing page. Enter your Bluebird card number and the Vanilla Reload PIN (see screen capture below) or call the number on the back of your Vanilla Reload cards, and tell them that you want to put all of both cards on your Bluebird card. You can load $1,000 every 24 hours. It loads instantly to Bluebird, so you can sign into Bluebird.com and pay your bills. It’s just like online banking at your current bank. With Bluebird, you are able to pay bills with money that originally came from a credit card. I have written that I use a credit card to pay for everything I can.

When I signed up for a Bluebird card, the Customer Service Rep said the most I can load on the card is $10,000 per month. The most I can spend to pay bills is $5,000 per month to non-registered payees. It’s $10,000 per month to registered payees. We checked and found that my mortgage company is a registered payee with Bluebird, as is the LA County Tax Collector.

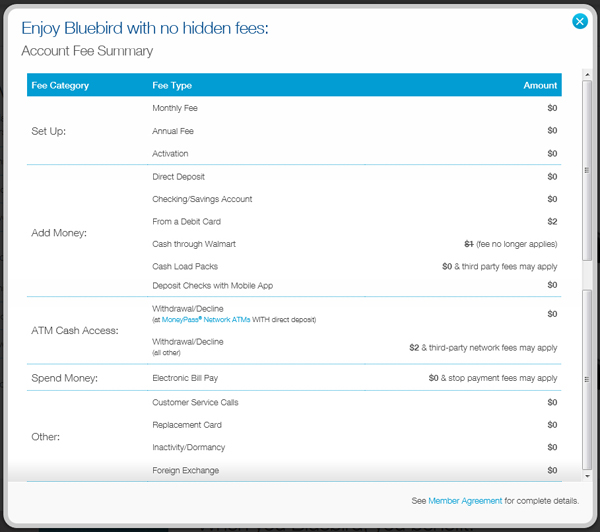

If this sounds interesting to you, go to Bluebird, click “Register Now”, and sign up for your free account. You can make direct deposits, pay bills online, deposit checks with your iPhone or Android. There are no annual, monthly, overdraft, or minimum balance fees. You can send and receive money to/from anyone with a Bluebird account. There are no credit reviews. It’s an American Express product but is NOT a credit card. You can have the worst credit in the world and do this. See their video and fee chart below.

Remember: You will use a credit card to buy Vanilla Reload cards to fund your Bluebird.

Click on “Chip’s Favorite Credit Card Offers” at the top right side of this website for up-to-date deals, terms, and conditions on cards with big sign-up bonuses. Email me if you have any questions about which card might be right for your situation.

Hi Chip-

My mortgages are both with a local bank so i suspect they won’t be “registered payees”… is there a way to check before opening an account?

Thanks for the tip!

Hi Mike,

At the time that I signed up for Bluebird, I got on the phone with their Customer Service and asked the same question. They said that if their system accepted my payee, then that payee was considered a “registered payee”. I entered my mortgage company – which is one I had never heard of, by the way. Their system accepted it. Then the CSR confirmed that it was a registered payee. Sweet!

I did this within minutes of registering for Bluebird. I did this before getting my card. I say register and enter some payees. Then wait for your Bluebird card to come in the mail. That’s where I am on this.

-Chip

Are you sure you can fund Bluebird using a gift card as you suggest above?

It says on the Bluebird web site that you can only deposit from another bank or direct deposit.

Chip

You say ” I entered my mortgage company – which is one I had never heard of, by the way.”

You had not heard about your own mortgage company? How did you get a mortgage then?

Yep. I like to double-check things, so I spoke to another American Express CSR about this. She said, “Once you get your Bluebird card in the mail, you can load it up with a Vanilla Reload card, sometimes referred to as a ‘Vanilla Pack’ card. Call the number on the back of your Vanilla Reload card and have them load it into your Bluebird account.” Once I get my Bluebird card, I will let you know what happens!

I dunno if my mortgage guy found them or if they bought the servicing of my mortgage from some bank: Homeward Residential. I wrote about my recent refi.

Hi Chip! Loving these tips. Regale me: What’s to keep me from buying, say, $5000 worth of Vanilla Reload cards this month (from Office Depot, with my Ink Bold card), plunking them into/paying off my Ink Bold bill with Bluebird, and raking in the sweet, sweet rewards/points? C’est arbitrage! No?

Jason, you are a mad genius worthy of residency in Gotham City! I know people who did exactly what you proposed. But… word on the street, and in my area Office Depots, is that they are no longer carrying the Vanilla Reload cards. You can still purchase regular Vanilla Visa gift cards at Office Depot. Vanilla Relaod and Vanilla Visa are two different cards. You can then use the Vanilla Visa gift cards anywhere Visa is accepted – including AmazonPayments. My local Office Depot allows you to fund Vanilla Visa gift cards with $20 – $500. There is a $4.95 fee per card.

So if you find the 90 day clock running out since getting your Ink Bold card, and you are still a few bucks shy of the $5,000 spending requirement to get the 50,000 points sign-up bonus, you could pick up a Vanilla Visa gift card or two to spend like a regular Visa in the future. As for buying $5,000 at once, I dunno if that throws up any red flags or not.