4.09% is atop the Rate Leader Board. Find it at Waukegan’s own Consumers Credit Union. Apply online. You can get a $50 bonus just for trying them out for two full months. The Free Rewards Checking rate is guaranteed through June 30, 2012 on deposits up to $10,000.

4.09% is atop the Rate Leader Board. Find it at Waukegan’s own Consumers Credit Union. Apply online. You can get a $50 bonus just for trying them out for two full months. The Free Rewards Checking rate is guaranteed through June 30, 2012 on deposits up to $10,000.

Think outside the box, outside the 9 dots, baby! Yes, this is a “checking” account, but think of this as an awesome 4.09% savings account. Having the Free Rewards Checking account does not mean you must close your current checking account and move all your banking to CCU. Take them up on their $50 offer (expired) to try them out. While doing so, get 4.09% interest on your money.

UPDATE: The $50 bonus has ended. Starting July 1, 2012 the 4.09% rate is scheduled to drop to 3.09% for balances up to $5,000.

The monthly hoops you must jump through are very doable! You can do this by making 12 debit purchases and paying a bill using their free online billpay. Are you hip to how AmazonPayments works? Use it to pay back your friends for lunches and what-not, using your debit card, to help meet the 12 debit transactions requirement.

No ATM fees, No minimum balance, Free Online Banking and Billpay.

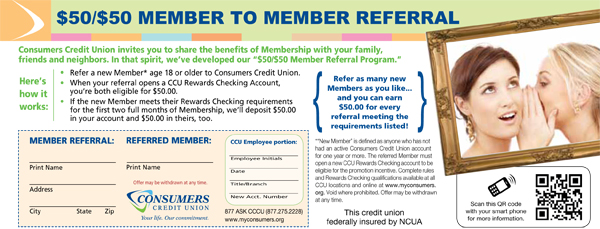

You can get the $50 Bonus after opening the Free Rewards account with a referral and meeting the requirements for your first two full months. Apply in March. Meet the requirements in April and May. Get $50.

You do not need a referral to open the account, but do need it to get the $50 bonus. If you would like a referral: Email me the name you used to set up your account. I will fill out the form below and send it in. Then we’ll be rich. Rich, I tell you. RICH!!

I’ve never tried credit card arbitrage before, but I’m considering getting the Chase Slate card and doing a no-fee transfer to an interest-generating account like this one. But if the 4.09% APY is guaranteed only through June 2012, what are the chances that rate will fall after June, making the whole thing a waste of time?

@Jonathan – I just got off the phone with Consumers Credit Union. The CSR told me that on July 1, 2012 that rate will drop to 3.09%. She said the 4.09% has been there for 2.5 – 3 years. With that rate history, it might be a safe bet that the 3.09% will be around as long as the Slate card’s 15 months of free 0% money. In any case, you are certain to make something and definitely not lose money.

Thanks Chip!

So how exactly does this work? Here’s what I gather…

1. apply for both accounts

2. max out the 0% credit card and drop it into the checking account

3. wait 15 months and pay back the credit card

??

Doesn’t this affect credit score? How did yours stay @ 797? I thought adding new lines of credit, increasing credit utilization percentage, and increasing credit-to-debt ratio will affect the score…

@ Adam, you will have to make minimum payments on your Chase Slate card every month. You will also have to pay off the Case Slate card in full after 15 months.

Will your credit score drop if you apply for new credit? FICO says, “If it does, it probably won’t drop much.” http://www.myfico.com/crediteducation/factsfallacies.aspx

When you apply for a new card, your available credit limit goes up, which helps your score. If you use it, that may bring your score down a few points depending upon how much debt you start to carry. Or if you are like me and have a lot of unused credit limit, putting some 0% debt on a card could just be a wash.

You would apply for the Chase Slate card and move that available line of cash to one of your other cards (Credit Card X). Then ask Credit Card X to send you a check for your recent overpayment. Take that Credit Card X money and put it in your CCU account at 4.09%

How to charge the cash from the new slate card to a previous card? Doesn’t that count as a “cash advance” which is subject to a fee or is that a balance transfer to a previous card (fee also)? What about holding a revolving balance on the new slate card? What about the available credit after each month of minimum payments? Charge it again?

As for available credit…I’ve got 3 cards total, with about $80k total credit limit, combined with about $60k in debt (student loans). Any idea what kind of limit Slate would approve for? I’ve got a 700-730 score….

Hi Adam, you are not charging cash. You are sending money from Chase Slate, 0% for 15 months and no fee, to another credit card (Credit Card X). The No Fee has been hard to come by lately but Slate does it if you transfer the funds in the first 30 days your account is open. Otherwise you will pay 3% of the amount you are transferring as a fee, or $5 whichever is greater.

So Step1: Apply for the Chase Slate card.

http://www.chipsmoneytips.com/2012/02/slate-as-in-clean-2/

Step 2: After you get the Chase Slate card. Transfer to another card of yours (Credit Card X).

Step 3: Contact Credit Card X and ask them to cut you a check for the overpayment you just made.

Personally, whenever I have done this, I take all the money out of the 0% card and then I make the minimum payments until the 0% goes away. Then I pay it off in full. I do not keep making transfers. That would be unwise these days, especially with the terms of the Slate card, because you would have to pay 3% fee on any balances transferred after 30 days.

730 is a nice credit score. I do not know the amount you could get approved for by Chase Slate. Let us know!

Don’t know if you saw this, but CCU is dropping their rate to 3.09% and for only upto $5k….kinda shitty.

What is really unfortunate is that 3.09% is still good these days! Oh well…

I followed the steps and I am set up with Consumers. Worked like a champ! Free money for a year! I can live with 3% Tks. Jesse

Isn’t when you do a balance transfer to a 0 balance account, that account will have a negative balance. And, you can withdraw that amount to the saving account and earn interest? I have BofA Credit Card, and 0 balance. I plan to do a balance transfer there. Is there anything I need to watch out for BofA credit card?

Getting money loaned to you for less than you can make in interest elsewhere is the goal. FYI: The CCU account now only pays 3.09% on $5K, down from the offer at the time of this original post.

You want to transfer cash that you got for cheap (or better yet, free via Chase Slate) to another account, pulling out the cash, then earning interest on that cash is the goal. Banks have different rules, so you should call up BofA and ask them about your “hypothetical” scenario. For starters, make sure they allow you to overpay your account, and will send you the overpayment if you want it.

Thank you, I just call BofA today. They said that whenever a transfer from BofA CC, they will charge as cash advance. I guess, I will just request Chase to write me a BT check to my checking acct.