Please Click here to Tweet this post (I hope).

Have you seen the Geico ad in which Kenny Rogers is playing poker while singing “You Gotta Know When To Hold ‘em”? Mi amigo Wayne is the guy who tells The Gambler “I get the gist, yeah.” See the funny ad below.

Wayne and I were talking the other day about whether or not it would be a smart idea to take early retirement from the Screen Actors Guild (SAG) pension.

Maybe you find yourself in a similar conundrum at your place of employment. I will use the SAG pension as an example. Hopefully, some of the decisions we face will be similar to yours.

SAG would pay out 100% of what is waiting for us if we don’t take it until we’re 65. We could take it as early as 55, but we’d only get 70% of what we’d get at age 65. That is because for every month we take it early, the benefit is reduced .25%.

My initial reaction was that the bean counters who pore over the actuarial tables are not going to make it more attractive to pay out money early. But after running the numbers, and conferring with two accountants and three financial planners, it looks like early retirement might be a good move. There are some factors to consider.

In A Nutshell

I realize that lots of folks want a quick answer. Suffice it to say, if I were 55 and never planned to earn another dollar in SAG, I’d take early retirement now and never look back.

Some things sound too good to be true. Convinced we missed something, I spoke to Maggie in the SAG Pension office. She said that the SAG Trustees wanted to make early retirement a real benefit. To paraphrase comedian T. Sean Shannon, maybe that’s because acting, like being a transvestite, is a young man’s game. Let’s face it; there are only so many catheter commercials and Rappin’ Granny roles available.

Some things sound too good to be true. Convinced we missed something, I spoke to Maggie in the SAG Pension office. She said that the SAG Trustees wanted to make early retirement a real benefit. To paraphrase comedian T. Sean Shannon, maybe that’s because acting, like being a transvestite, is a young man’s game. Let’s face it; there are only so many catheter commercials and Rappin’ Granny roles available.

Let’s crunch some numbers

For simplicity, let’s say you will get $1,000 per month at age 65, or $700 per month at age 55. SAGph.org says “The reduced (early retirement) payments are designed to pay you approximately the same amount during your expected lifetime as would have been paid to you over your expected lifetime if you had retired at age 65.”

If you started taking the $700 discounted retirement at 55, by the time you are 65, you would have received $84,000 ($700 x 12 months x 10 years). That’s quite a head start on future-geezer you!

If you waited until you are 65 to get your full retirement benefit of $1,000 per month, it would take until you were just over 88 years old to catch up to what you made taking early retirement at 55.

Here’s how I got that: $700 per month times 10 years = $84,000. If you wait until age 65 to start collecting your pension, you’d get $300 per month more than what you’d get at age 55. Divide that $84,000 head start by $300 and you get 280 months. That is how long it would take you to collect as much money if you started at 65 as you would if you started at age 55. Of course, 280 months divided by 12 = 23.3 years. 65 + 23.3 = 88.3. It would take you until you were 88.3 years old for the amount collected at 55 and 65 to intersect.

This is just simple math, not taking into account interest, inflation or the present or future value of money.

Interest

Now let’s take interest into account. Even with today’s horribly low interest rates, you can get 3% on a 6-year CD at MidFirst Direct Bank. Using the Savings Interest Calculators I got here, look at the impact of that 3% interest. This shows what you would have at 89 years old.

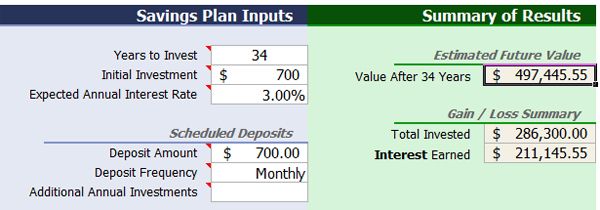

Taking Early Retirement at 55:

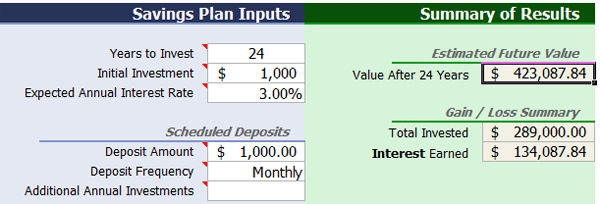

Taking Full Retirement at 65:

A couple things can be gleaned from these screen shots.

- The amounts under “Total Invested” are the sum of the monthly pension payments only. These are the amounts that were collected starting at age 55 and 65. Those amounts intersect when we are 88+. This particular calculator did not allow me to break it down to the exact month, but it’s when you are 88+.

- Although the monthly payments are lower if taking retirement at 55, as you can see, the “Interest Earned” is much higher by age 89. In this example, you will be about 116 years old before the pension payments taken at 65, plus interest, catch up to those taken at 55, plus interest.

I realize most people are going to spend their pension. Maybe you are one of those out there who have scrimped and saved all along in your career, and don’t need the pension money. You can see how taking early retirement can build a nice pile of dough for something else like travel, tuition, a second home or other investments.

Inflation

Because inflation weakens the buying power of money, you can bet that money is probably worth more now than it will be later. Your fixed monthly pension payment that you take in early retirement is worth more than the same amount at 65. You gotta factor in inflation. The average annual inflation rate since 1913 is about 3%. Check out this video on inflation:

If you’d like to see how the spending power of your dollar usually decreases over time, play around with this inflation calculator.

What’s The Catch?

There’s always a catch, right? Maybe.

SAG’s pension is a defined benefit plan, which means you know exactly how much you will collect each month until you die. SAG’s pension plan is odd. Almost every company that has a retirement plan, gets you off payroll once you access retirement. But SAG lets you collect your pension – AND still allows you to work. That is unusual.

Once you take early retirement, there is no going back. So choose wisely. Here’s why that is important.

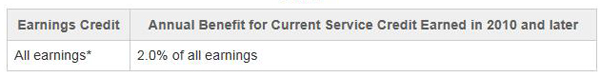

If you are NOT retired, and you make enough money in SAG session fees and residuals to earn a pension credit (currently $20K/calendar year), you get 2% of that money added to your annual pension pile at age 65. For example, 2% of $20K is $400/year added to your annual pension at 65. 2% of $30K is $600/year. 2% of $47,843 is $956.86, and so on, and so on. Business as usual.

But if you ARE retired, and still working in SAG, it is possible to make enough money to earn a SAG pension credit. But if you do, it is possible that NONE of those earnings will go into your annual pension pile. That is significant. In my opinion, that’s The Catch.

But if you ARE retired, and still working in SAG, it is possible to make enough money to earn a SAG pension credit. But if you do, it is possible that NONE of those earnings will go into your annual pension pile. That is significant. In my opinion, that’s The Catch.

If you ARE retired, and still working in SAG, it is still possible to have what you earn go toward your pension. You MUST meet a couple requirements. I spoke to Maggie in SAG’s Pension office about that. You can read the rules here at SAGph.org. but here they are for your retiring-early-but-still-having-earnings-added-to-your-pension enjoyment:

“…your pension will be suspended for any month in which you are younger than age 65 and have sessional earnings that equal or exceed an amount equal to 7 days multiplied by the minimum day player rate under the TV and Theatrical Agreement, rounded up to the next $100… Therefore, your benefit will be suspended if you have sessional earnings of ($6,200) or more in a calendar month… Once you stop working in prohibited employment, you will start to receive your pension again in the same amount you were receiving prior to the suspension. At the end of the calendar year, your total earnings (sessions and residuals) will be reviewed. If your total earnings for the calendar year equal or exceed the minimum earnings required to earn a Pension Credit ($20,000 for 2014) your pension will be recalculated when you reach age 65 based on all of the earnings reported in that calendar year, subject to the Plan’s minimum and maximum pension amounts. Because the additional benefit is paid at age 65, it will not be reduced for age. If your total earnings for the calendar year are less than the minimum earnings required to earn a Pension Credit, the amount of pension that was suspended during that year will be refunded to you.”

Making $6,200 in session fees in a calendar month is not easy for most actors. There are fewer TV shows under SAG terms. You might be able to meet the session fee requirement in theatrical work, but you would be hard pressed to do it in commercials alone.

Where early retirement would be bad

Let’s say you become one of the go-to gray-haired wonders who book all the spots for People of a Certain Age. You find yourself holding hands outside in his and her bath tubs for Cialis, grabbing your lower back in agony for Doan’s Pills, and uttering the greatest words ever spoken “I’ve fallen and I can’t get up!” The spots run well and you make enough for a pension credit. The problem is if you did not make at least $6,200 in a calendar month in session fees, none of these commercial session fees or residuals will contribute to your pension.

So if you shoot a bunch of commercials and think you will make over $20K that year, it may be better to hold off on early retirement, earn another pension credit, and have that money go into your annual pension pile. Then take early retirement when you figure you will not make $20K in residuals or a combination of the daily rate x 7 and residuals reaching the pension credit amount.

Taxes

Pension money is taxable in most states. You will get a 1099-R at the end of the year.

The IRS website said a pension may get hit with a 10% tax for early withdrawal before age 59½. I asked Maggie about that. She said that does not apply to the SAG pension for two reasons.

- It is an annuity paid out over a lifetime.

- SAG exploited a loophole making this a separation of service (even though one can still keep acting in SAG jobs).

Unemployment

Since you can collect your pension early, and still keep working, many actors wonder if they will be able to collect unemployment and their pension at the same time. SAGph.org’s FAQs say: “It is possible that your pension from this Plan may affect your eligibility for and amount of Unemployment Compensation benefits. Please check with the Plan Office and your local Employment Development Department office.” If unemployment is a concern to you, you have some calls to make.

Pay Attention To Your Pension Credits

Know how many pension credits you have and/or need. Remember, those credits are based upon earnings in a calendar year. Read more about the SAG Pension here. Maggie at SAG Pension told me that if you get 10 pension credits, not necessarily in a row, you can take your pension as early as 55 years old. She said that if you get pension credits for five years in a row starting in 1999, you are guaranteed a pension at age 65. You can’t retire early with this “Limited 5-Year Vesting”. Those with Alternative Pension credits (from doing extra work) cannot retire early either.

(Update 7/25/15) In case you are wondering, it is possible to delay taking your pension until after you turn 65. I don’t see the benefit, but it’s possible. SAG Pension and Health says your monthly pension will increase by 1% for every month you wait. The $1,000 per month at age 65 would be $1,010 per month if you wait a month to start taking your pension. If you wait 12 months, you get an increase of 12% or $1,120 per month. And so on. Remember, for every month you delay taking your pension, you don’t get anything. So if you delayed one month, you miss out on that $1,000 payment. Starting the next month, you will get $1,010. It will take you 100 months of that extra $10 per month to have hauled in an extra $1,000. That does not even take into account interest lost. Unless you plan to live to be 200-ish, don’t wait to take your pension after 65.

In Closing

It would be very difficult for me to cover every wrinkle of every possible scenario, so do your own due diligence. Please don’t take only my word for this stuff. Personal Finance is about personal responsibility. Run your numbers yourself. Check with your financial advisors. Call SAG Pension and Health with any questions and/or read the information at SAGph.org. Use SAGph.org’s calculator to run estimates. To do that, sign in at www.sagph.org > Pension Planning Tools > Pension Estimate.

If you are close to being vested for a SAG pension, focus and make a plan to get there. If need be, take jobs which underuse your talent. If you normally do guest star parts, consider taking co-star roles and “Under 5” line parts in movies. Call in some favors.

I suggested this to a friend of mine. He needs one more pension credit to have 10 pension credits. If he gets that 10th credit, he can retire early. The money you need to make for a pension credit is in a calendar year. Make it a New Year’s resolution for January or hustle it up by the end of this year if you are close.

You won’t mind having been “Spear Carrier #3” when you are collecting that check every month for the rest of your life.

Very impressive analysis, Chip. Have you perhaps done a similar one for Social Security?

Thanks John, I have not tackled Social Security yet. It is on my To-Do list!