My bromance with my Chase Ink Plus has never been stronger. For a limited time, they boosted their sign-up bonus… to 70,000 points!! That is worth $700 in TAX-FREE cash. You could also redeem the points for $875 in travel booked through their travel search engine. See why I am smitten?

My bromance with my Chase Ink Plus has never been stronger. For a limited time, they boosted their sign-up bonus… to 70,000 points!! That is worth $700 in TAX-FREE cash. You could also redeem the points for $875 in travel booked through their travel search engine. See why I am smitten?

Click on “Chip’s Favorite Credit Card Offers” at the top right side of this website, then “Business Cards” for up-to-date deals, terms, and conditions on this card and more. Email me if you have any questions.

Why should you get this one? It’s Rock-tober people. It’s only a handful of weeks until Christmas, Hannukah and Festivus. That means you could probably use some extra cash. And… here’s how you can actually get $700 tax free!

Why should you get this one? It’s Rock-tober people. It’s only a handful of weeks until Christmas, Hannukah and Festivus. That means you could probably use some extra cash. And… here’s how you can actually get $700 tax free!

1. Apply for an Ink Plus Business Card.

“Business” – What the??? I’ll explain later.

2. Spend $5,000 in the first 3 months from account opening. “$5,000 – What the???” Check out 11 Ways To Meet A Spending Requirement for easy, frugal ideas to help achieve that.

Once you meet the spending requirement (check out my 11 Ways…) and your statement drops, your points show up (like mine did) and you can have them send you a check. Apply now, and you could be loading up on top shelf egg nog!

The card has other perks including:

- No Foreign exchange fees – a huge money saver for globetrotters.

- 1:1 point transfer to leading frequent travel programs (including United and Southwest Airlines).

- Earn 5X points per $1 on the first $50,000 spent in combined purchases at office supply stores and on cellular phone, landline, internet and cable TV services each account anniversary year.

- Earn 2X points per $1 on the first $50,000 spent in combined purchases at gas stations and hotel accommodations when purchased directly with the hotel each account anniversary year.

- (UPDATE 10/2/14) Annual Fee? When I wrote this post, I would have sworn the application said the $95 annual fee was waived the first year, as has been the case with Ink cards. When I received my card two days later, I jumped online to see a $95 charge on my new card. I called the number on the back of my card. The CSR told me that there is not supposed to be an annual fee on this card. She credited my account and said that credit will show up in 1-2 business days. So if you get charged like I did, call them and ask if they will remove it.

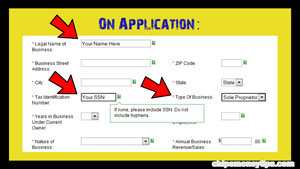

It’s a “business” card, but that doesn’t really mean much since you don’t have to have a corporation or LLC to get this card. If you just said, “A what?” Don’t worry about it. You’ll apply as a “sole proprietor”.

It’s a “business” card, but that doesn’t really mean much since you don’t have to have a corporation or LLC to get this card. If you just said, “A what?” Don’t worry about it. You’ll apply as a “sole proprietor”.

Cuz, if you make money doing stuff – you are a “sole proprietor”. Are you a Handyman, actor, dog walker, nanny, seller of stuff on ebay – congrats you are all sole proprietors!

In the application, for “Type of Business” choose “Sole Proprietor”. Put Your name as the business name and Your Social Security number where it asks for Tax ID.

In the application, for “Type of Business” choose “Sole Proprietor”. Put Your name as the business name and Your Social Security number where it asks for Tax ID.

Think about it. If you and your significant other do this – you’ll be loaded!

- If you get denied or want an answer after you apply, call the Reconsideration Line (800) 453-9719

- The IRS definition of a Sole Proprietor

- Will your credit score drop if you apply for new credit? FICO says, “If it does, it probably won’t drop much.”

Thank you for clicking on “Chip’s Favorite Credit Card Offers” at the top right side of this website for up-to-date deals, terms, and conditions on these cards and more. I appreciate it! Not only will that ensure you get the correct offer, but we may get a referral credit from approvals. That support helps keep the 1s and 0s spinning around cyberspace bringing great Chip’s Money Tips to you!! Many graciases. Email me if you have any questions.

Hi Chip,

I know you have a business history with your bank, but I don’t. They asked me for financials and I didn’t have any so I got declined. Any suggestions?

John

Hi John,

I got this card for my landlording/real estate biz. They accepted my information without needing any documentation. You could try calling them back. Maybe you got a cantankerous CSR 🙂

Applied! And now we wait up to 30 days to receive the decision via snail mail (according to the Chase application web page after submission).

If I am not instantly approved, I call 800-453-9719 and ask if they can expedite my approval. They have always been very nice about it. Good Luck!