> Probate Shortcuts – By State or click here, choose your state, click Probate Shortcuts

> Allowable Probate Fees – California

> Use a Revocable Living Trust to Avoid Repeating Probate in Several States

Video Transcript:

As I explained in Parts 1 & 2, your cash, stocks, and retirement accounts can completely avoid Probate, but what won’t escape the grasp so easily is your real estate. Unless…. You have a Revocable Living Trust . Also pronounced REV-uckable, which is completely acceptable if your attorney is James Mason or is wearing a powdered h-whig.

Either way you say it – if you own a house, you should probably get one. You can pay an attorney to set one up for you or use some online legal service like LegalZoom and do it yourself for a lot less money. There should be an ad below this post at ChipsMoneyTips.com and if you go thru there, I get a little bit of this (money).

Generally speaking, when you punch out, the State totals up how much cash, stock, real estate, and stuuuuff that you have. If it’s under a certain limit, you’re good. Otherwise, your Estate has to go thru Probate. If you are watching this at ChipsMoneyTips.com, there is a link underneath this video that will tell you what your State’s limit is.

In California, the limit is one hundred thousand dollars. Now, I don’t know if you’ve heard, but property out here is expensive. And the state does not just count how much you put down on your house or condo, they count the appraised value of your property. Even if you owe money on it, the full value is subject to Probate fees.

How much are these pesky fees, you say?

4% on the first $100K

3% on the next $100K

2% on the next $800K

1% on the next $9M

The peskiness adds up! Unless, that is, you have a Revocable Living Trust, which is pesky proof and avoids probate completely.

Let’s use the example from Part One, in which Joe Blow died with $225K in cash and stocks. Let’s also assume he bought a $500K house with a $100K down payment a month before he died in a freak boat accident. (on cam – That was no boat accident!). Therefore Joe’s Estate would have Probate Fees of $17,500 (Graphic, not spoken: $4K + $3K + $10,500) despite owing $400K on his house.

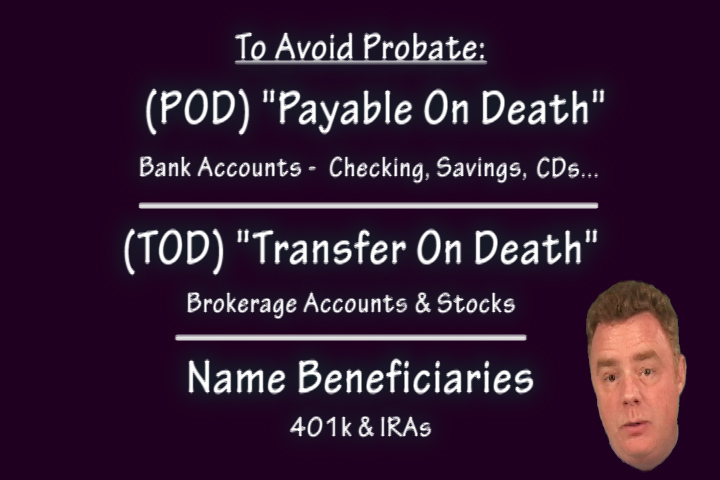

Even if he had put his cash and stocks in POD & TOD accounts as I talked about in Part 2 – Electric Boogaloo, his Estate would still have to pay $13,000 in Probate Fees, due to the real estate. That is money that otherwise would have gone to his heirs.

So… Which would have been the best deal for The Blow Family?

a) Do nothing. Spend $17,500 in Probate Fees

b) Use PODs and TODs. Spend $13,000 in Probate Fees

c) Have an attorney draw up a Revocable Living Trust. Spend $1,000-$5,000 and pay no Probate Fees. OR…

d) Use an online place like LegalZoom to draw up the Trust. Spend $249 and pay no Probate Fees

The correct answer is C or D.

That’s right: If Joe Blow had set up a Revocable Living Trust, he would have saved his heirs $17.500 in Probate Fees.

Here’s a very important, bonus tip. If you own property out of state when you die, your out-of-state property must go through probate court in each state. This also can be avoided by having your property held in your Revocable Living Trust.

If you are watching this at ChipsMoneyTips.com, you will see links below this video that will take you to sites that support this information.

So……… if you own a house, the best thing is to form a Revocable Living Trust. Otherwise, at the very least, EVERYONE should do the free option of putting your bank accounts and stocks as “Payable On Death” or “Transfer On Death”, and name beneficiaries on your retirement accounts. That avoids Probate. Your heirs will thank you for it! And, you’ll look pretty smart from the grave.

I never knew The Search for Spock would be so educational!