> States that allow TOD on vehicles

> Securities and Exchange Commission – Regarding Transfer On Death (TOD) Registration

> Probate Shortcuts – By State or click here, choose your state, click Probate Shortcuts

> Allowable Probate Fees – California

> Allowable Probate Fees – Ohio

> Use a Revocable Living Trust to Avoid Repeating Probate in Several States

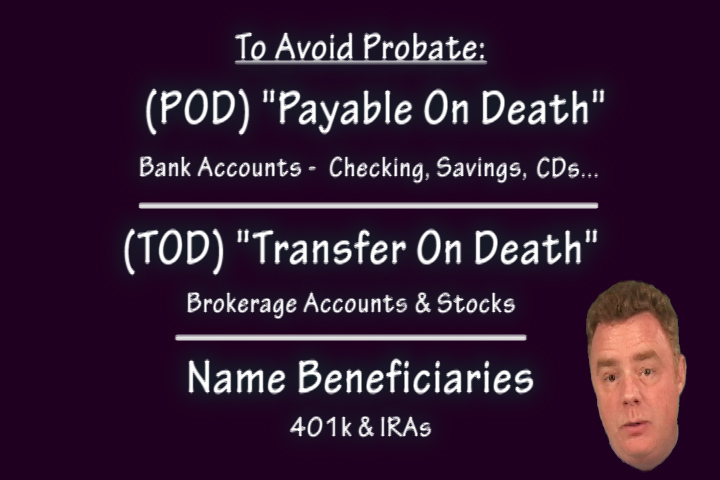

> Avoid Probate with Payable On Death (POD)

Video Transcript:

Welcome to ChipsMoneyTips Part 2 – Electric Boogaloo. Now with Gravitas! This is an easy fix. Get your POD & TOD ASAP. That’s it. Good luck to ya! Allow me to explain.

To avoid Probate, put the designation of P.O.D., Payable On Death on your bank accounts – checking, savings, CDs – and T.O.D., Transfer On Death on your brokerage accounts & stocks, and simply name beneficiaries on your 401k & IRA retirement accounts. Then when you keel over, those assets will pass automatically to the beneficiaries you designated. Some states even allow you to put a TOD on your car’s registration too.

And all you need to do to get those designations is simply ask for them. Just like the Mother May I game we played as kids, you can have this just by asking. Mother May I not pay Probate Fees? Yes, you may. It’s virtually that easy. And it’s FREE!

All you are doing is naming a beneficiary for those accounts. You can change it at any time. The important thing is to get it done. Do it to your existing accounts – just pick up the phone and call the institutions where you have those accounts. And do it on accounts you open in the future.

Most people don’t find out about POD’s and TOD’s until it’s too late. That’s what happened to us. When my mom passed away, she had just received over $5,000 in stock dividends in her checking account. At the time, we did not know about having her bank account “Payable On Death”, so her Estate was allowed to be charged $275 in Probate fees on that $5,000 alone. Had we known to label her account “Payable On Death”, we would have completely avoided Probate Fees on that $5,000. Had we known about this, as you do now, wink, wink, twist arm, that phone call to the bank would have saved us a lot of money.

If you are one of those people who say, “So, what? What’s $275?” I will gladly provide you with wiring instructions to my bank account so you can send me some.

So, contact your banks and the brokerage house or company that holds your stocks – maybe it is the company itself like GE or Procter & Gamble) and ask them to have your accounts held as POD or TOD. Then, ALL of that money avoids getting hit with probate fees. All of it. ALLLLLLLLLL of it.

A few quick phone calls can save your heirs thousands of your hard earned dollars. And don’t forget the Geezers in your life. Send them a link to this video. Why give away money to a probate court-appointed stranger when you can keep that money in your family???

Finally, having your assets held in a Revocable Living Trust will also do what POD & TOD’s do, and then some. I will talk about this in my next video, Mother May I Avoid Probate – Part 3 – The Search For Spock , which you can see by clicking up here. A Trust can cost hundreds or thousands of dollars to set up – and you may not need it. But if you are loaded and/or own a house, – especially if your house is in California – you probably should have a Trust. Check out the next video as I disappear slowly into thin air, with all my gravitas.