If you are like me, you have done things in the past to screw up your credit. Like me, you can fix it – without a Hot Tub Time Machine or a fully-functioning Flux Capacitor. I’ll tell you how you can join me in rarefied credit score air so high you’ll wanna bring a Sherpa.

The past is the past. Mistakes do not have to continue. We all used to wear diapers, but at some point that way of life lost its appeal.

Having good credit is possible even if you defaulted on loans, made late payments on credit cards, have collection agencies bugging you, or have gone bankrupt.

As detailed in my post “I Cut My Mortgage Rate in Half” when I refinanced my house, my FICO credit score was 817. That’s on a scale of 300-850, thankyouverymuch.

Lipstick on a Pig

Even if you have sworn off borrowing any more money, you should polish up your credit report as best you can – and correct any mistakes on there. Employers are increasingly doing credit checks of job applicants. Yes, your credit determines rates at which you can borrow money, but also whether you have to pay deposits on utilities and cell phone plans.

Of course, landlords don’t like to rent to folks with a sketchy credit history. As I mentioned in “The Chickenpox of Your Report”, in my ten years of landlordiness I found that not all people with bad credit are irresponsible, but most irresponsible people have bad credit. Here’s how we un-sketchify your credit history:

Step #1: How Ugly Is This Monster?

What are we dealing with? Let’s find out how bad your credit report is. Every 365 days, you can download a free copy of your Equifax, Experian and TransUnion credit reports from AnnualCreditReport.com. Those are The Big Three credit bureaus. Get a copy of each. I strongly suggest you print out each full report to a PDF so you can easily reference it later. Download free PDFCreator here. You should download the software first, in case your computer requires you reboot. See my video post “Truly Free Credit Report” for more info.

Step #2: What The… What?

You may find some things that simply are not yours. Surprise! My dad and I have the same name. Somehow, his bank account wound up on my credit report. I was just a kid at the time that it was opened and did not have any savings. My paper route remuneration was heavily invested in baseball cards, SSP Racers, and Evel Knievel Daredevil accessories.

Some stuff may be incorrect. During the credit screening process for my rental property, one applicant was surprised to find out that he had an eviction on his report. He previously rented an apartment for 20 years. He had roommates come-and-go. When he finally moved out, the roommates stayed and eventually got evicted. Problem is that he and his original roommate were the only names on the lease and therefore they got the eviction – not the guys who actually got evicted.

Reviewing your credit report is also a way to find out if somehow has “stolen your identity”. I think that term is SOOO dramatic. But if someone is out there using your information to open up credit cards, they probably aren’t paying them off. Those cards would show up on your free credit reports.

In my recent Debt Strategy Sessions (check out the recommendations), there was a rash of medical payments that clients said they paid, but still showed up on credit reports as having gone to a collection agency. One friend found out this happened when he pulled his credit while refinancing his home. The claim dropped his score 100 points. He cleared it up and the claim was removed in time for him to refi at the lowest rate possible.

Step #3: Dispute The Errors

If you find something that is wrong, let them know. You can dispute The Big Three’s reports online:

- Equifax: Online Dispute

- Experian: Dispute Your Credit Report Online

- TransUnion: Initiate a Dispute on Your Credit Profile

Step #4: Pay Your Bill Before The Due Date

As I showed in “Infinite Monkey Theorem… and You!”, it benefits your score to pay off your credit card bill before the statement drops. When my credit report has been run, the amount that shows up on my report is the amount that was due on my statement. You can confirm this with your card company. By paying off my cards a couple days before the due date, my debt-to-credit-limit ratio (aka Credit Utilization) is lower. Don’t fall for the “Money Myth” that it’s good to carry a balance.

Step #5: Increase Your Credit Limit

Lower your debt-to-credit-limit ratio by increasing your available credit limit. Call your credit card company and ask if they can do this without doing a “hard-pull credit inquiry”. If they can, take the increase. If they want to do a hard credit pull, I would not do that right now.

Step #6: Mix It Up!

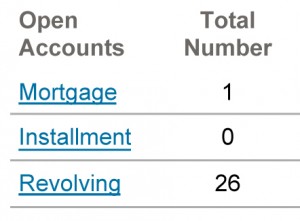

Credit bureaus like a mix of credit types like Mortgage, Revolving (varying payments like credit cards), Installment (payment amount and number of payments are set, like auto and personal loans). Those who read “My Hooptie’s Total Recall” and “Today My Car is a Man” know I am on my second car in 27 years. As you can see from my screen capture, I have no Installment loans.

Someday I might walk into my local bank branch and open a small personal loan to add an installment loan to the mix. You should consider that as well if you are trying to boost your score.

Step #7: Don’t Cancel Your Cards

You can cut them up, stash them in a drawer, or freeze them in a block of ice – but don’t cancel them. You need the credit line to boost your score. “Length of Credit History” is a factor in your score. The older the credit line is – the better.

Step #8: Now It Gets Weird

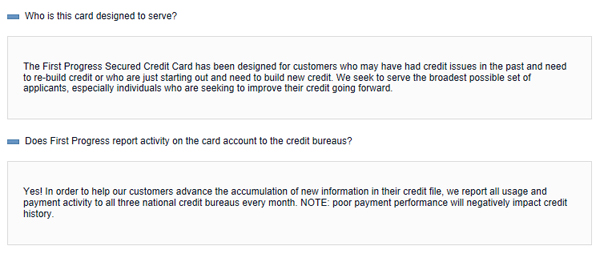

An easy way to build credit is by getting credit. But some of you are in a jam. You cannot get a credit card or a personal loan from a bank. For those of you in this Catch-22, a secured credit card is the answer. Not a prepaid card. You want a secured card.

A secured credit card requires that you deposit cash on that card. That amount is your credit line. You need the secured credit card to report to The Big Three credit bureaus.

Next, you must demonstrate that you have rehabilitated yourself, like Red in The Shawshank Redemption. Show that you can use the card to charge something every month, then pay it off when you get the bill. This activity shows up on your credit reports. After about a year of this, you should be able to get an unsecured (normal) credit card that doesn’t charge an annual fee.

There are fees for having a secured credit card – which vary widely. Don’t pay an application fee. Expect to pay an annual fee. Ask your bank or credit union if they offer a secured card.

Don’t get fancy with this opportunity. I suggest you use a secured credit card to pay for one of your recurring monthly bills, like a cell phone. Pay for your cell phone with your secured card, then pay off the secured card in full. That’s it. Don’t start using it at an ATM or for other crap. Use it to pay a bill. Then pay the card off in full. This responsible behavior will get reported back to the credit bureaus and you will be out of bad-credit jail before you know it.

If you are not going to pay this off in full every month, you should question how serious you are about rebuilding your credit. Tough Love.

If you have any questions about this stuff, leave a comment or shoot me an email.

From the FAQ: The card reports to The Big Three credit bureaus.

Thank you for clicking on the referral links in this post. I appreciate it! Not only will that ensure you get the correct offer, but we may get a referral credit from approvals. That support helps keep the 1s and 0s spinning around cyberspace bringing great Chip’s Money Tips to you!! Check out “Chip’s Favorite Credit Card Offers” at the top right side of this website for my other favorite cards.