I don’t know if I read this somewhere or if I got a hot tip from a drunk on a barstool. A while back I was informed that if you add someone to your credit card account as an authorized user, they can only benefit from it. If you made late payments or did not pay your credit card bill, those bad marks would go against you but not the authorized users. The authorized user’s credit score would benefit because of the length of credit history and credit line.

Well, that sounded ridiculous to me. Why would that work? Naturally, I had my sister and brother-in-law add my 10-year-old nephew and six-year-old niece to a credit card they rarely used, as authorized users back in September 2011. When those cards showed up in the mail, they were promptly cut in half and thrown away. The kids’ authorized user cards were never used. Their tiny fingers never touched the cards.

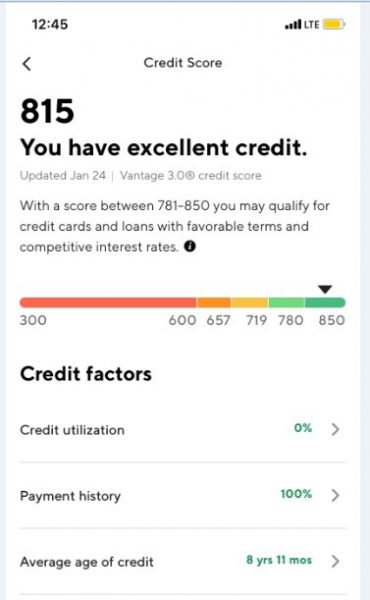

Cut to a couple weeks ago when my now 20-year-old nephew pulled his free credit score from his SoFi Money account. FYI: He has had his own credit card (no co-signers) for a little over a year. Here’s a screenshot of his 815 FICO Vantage 3.0 score from TransUnion. Note the average age of credit: 8 years, 11 months. I guess that trick worked! He certainly did not have any financial responsibilities that long ago.

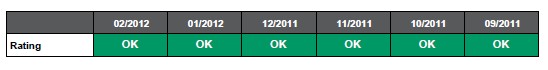

I know that we added my nephew as an authorized user in September 2011 because that is when the history on that card started showing up on his credit report:

I know that we added my nephew as an authorized user in September 2011 because that is when the history on that card started showing up on his credit report:

The Takeaway: Add your children to your credit card as an authorized user. It will probably help their credit score.

The Takeaway: Add your children to your credit card as an authorized user. It will probably help their credit score.