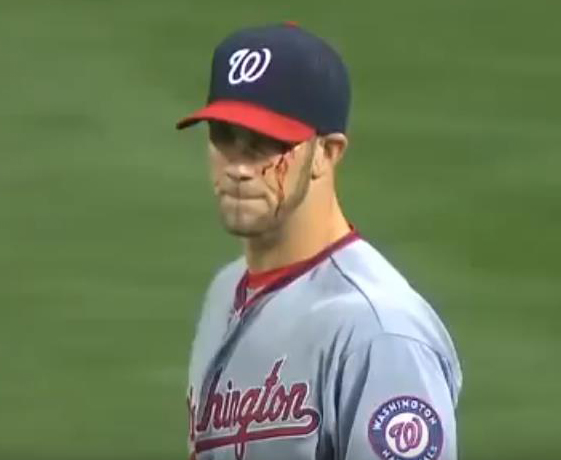

One of my earliest memories of Bryce Harper was a few weeks into his 2012 rookie season. After grounding out against my Reds, he took his bat down the tunnel from the dugout and whacked the wall with it. Well, physics took over and the bat whacked him right back. Bryce got a cut above his left eye that needed 10 stitches. I figured he was an immature, 19 year old idiot.

Turns out he was smart enough not to sign with a California baseball team. His agent Scott Boras said that Harper’s 13 year $330 million contract with the Phillies, a Pennsylvania team will save him about a year’s worth of compensation versus the same deal with a California team.

Why? Because California has the highest income tax rate in the nation, topping out at 13.3% Pennsylvania’s is a flat 3.07%.

What if Bryce signed with a California team? If he made his home in California, he’d get taxed at the state rate for all the games. Bryce lives in Las Vegas, so he’d get taxed by California for the 81 home games. Players are taxed by the home team’s state rate. In 2019, the Dodgers play 20 away games in California. That’s 101 games at California’s super high tax rate.

Looks like Bryce has outgrown some of the foolishness of youth. He no longer beats up concrete walls. He also kept his eye on his take-home pay.

Where You Live Matters

You and I may not have to make a decision that would save us tens of millions of dollars, but we can save tens of thousands of dollars.

My hometown of Cincinnati has a tax of 2.1% of on those who live and/or work in the city of Cincinnati. My backdoor neighbors lived in the city and we lived in the county. If their household made $100,000, they’d have to pay the city an extra $2,100 every year. EVERY year.

I know people who live in Florida six months and a day to establish residency in that no income tax state to avoid paying income tax in Ohio where they live the other 182 days a year.

A friend plans to move from Los Angeles to no state income tax Nevada when they retire. That will be a 9.3% savings for her by avoiding California’s state income tax. If she and her husband bring in $100,000 a year, that will be a savings of $9,300 a year.

Bryce gave himself a nice pay bump. That was pretty smart.

Check out the Los Angeles Times article Bryce Harper will save tens of millions in taxes by spurning the Dodgers and Giants for more details.

Interesting observation, Chip. It would be true if all other things were equal — but of course they never are. The value of endorsement deals in a major market like LA would more than make up for the added taxes. And as for Northern California, just ask Andre Iguodala, who started his NBA career with Philadelphia. He’s not even a starter with the Warriors, but being in the Bay Area has opened up the opportunity to invest in tech startups, which is not only lucrative but has become a passion for him, which will continue long past retirement. These kinds of opportunities are why, if we can, we’re all willing to pay extra for the privilege of living in California.

I left 20 years ago for a job. We would have made more money sitting in our house in California than we did working! And, of course, there’s the weather… When it’s 90 degrees and 90+% humidity in Georgia, paying to live in California seems like a good deal. There are lots of livable places in the world and I live in one of them, but if I could turn back the clock I’d stay in California and suck it up and pay my taxes!

But can you hit 30 homers and drive in 90 runs? I often think i pay for the weather out here.