If you are a California resident, you can get a Southwest Companion Pass by getting a new card and making only one purchase. This is huge.

That’s right. Get a card; use it to buy a pack of shoelaces… a stick of Beemans… ANYTHING! Just make one purchase and you will get a pass for your companion through 12/31/18.

Southwest’s Companion Pass is one of my favorite things. It ranks up there with raindrops on roses and whiskers on kittens. It has saved me thousands every year.

Why? Whenever I buy a ticket on Southwest or use Reward Points to get a ticket, I can get a second ticket FOR FREE for my Companion. I blather on more about the Companion Pass here.

You could fly every day on Southwest and your Companion could take every flight with you free. Only thing your Companion pays is taxes and fees of at least $5.60 each way.

This is available on three Southwest cards:

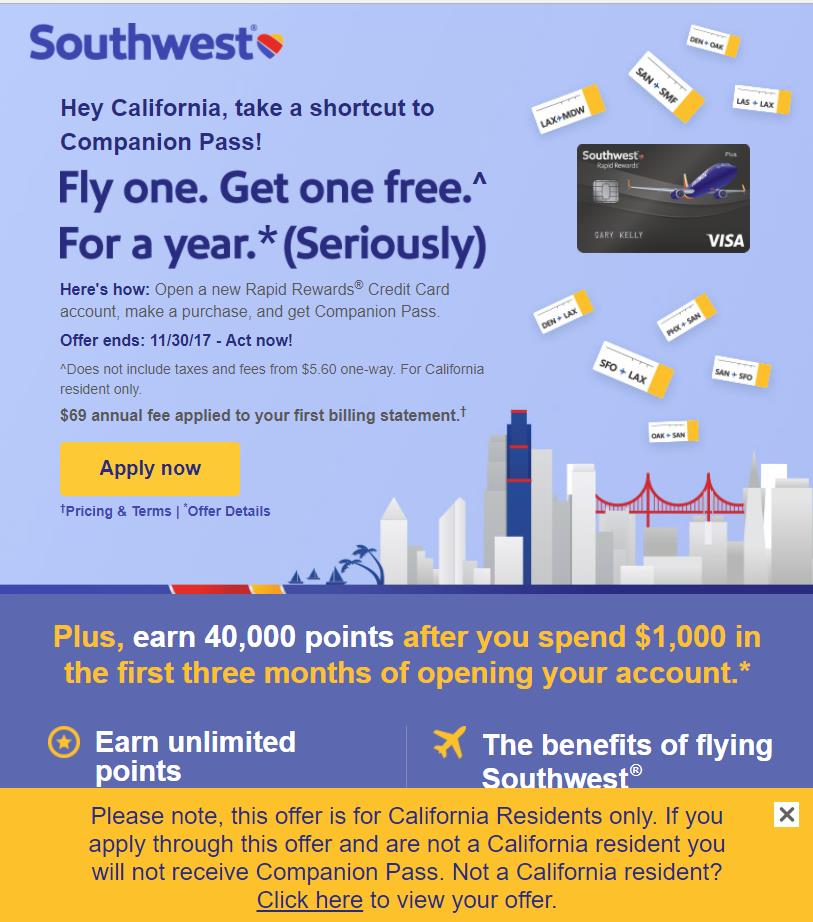

Plus (Personal): $69 annual fee. Get 40,000 point bonus on $1,000 spend.

Premier (Personal): $99 annual fee. Get 40,000 point bonus on $1,000 spend.

Premier (Business): $99 annual fee. Get 60,000 point bonus on $3,000 spend.

Californians get the Companion Pass after making a single purchase of any amount. The point bonuses above are yours if you meet the spending requirement in first 3 months your account is open.

Full disclosure: I may get a commission from the bank if you apply using a link via my site. I greatly appreciate it if you apply using my link. Email me if you have any questions. Where is this link you say?

You can find these cards under “Chip’s Favorite Credit Card Offers” at the top right side of this website. Click on “Travel Rewards Credit Cards”. This will take you to another site where you’ll get more info.

Once there, scroll down. The 18th card down is the “Southwest Rapid Rewards Plus Credit Card” and click the green “Apply Now” button. The 32nd card down is the “Southwest Rapid Rewards Premier Credit Card”.

Can any Californian get this? The fine print says:

- “Individual must have a valid California address as evidenced by their application for the Rapid Rewards Credit Card”. Use your real address – not a P.O. Box. They aren’t dummies. It would be too easy to fake being a Californian with a P.O. Box.

- You must open a card by 11/30/2017. Although I have gotten my Companion Passes in the past when I met the requirements, allow up to eight weeks for Companion Pass to be fulfilled after making first purchase.

- This deal is “not available to either (i) current cardmembers of any Rapid Rewards Credit Card, or (ii) previous cardmembers of any Rapid Rewards Credit Card who received a new cardmember bonus for a Rapid Rewards Credit Card within the last 24 months.” Sooooo… Even though I am a California resident and have long since closed the Southwest cards on which I got new cardmember bonuses which helped me get the Companion Pass in January 2016 – I cannot get this offer. Why? I got the bonuses 22 months ago. If you want to take advantage of the Californian promotion, and you have a Southwest card but it has been longer than 24 months since you got the bonus – looks like you’d have to close that sucker before applying.

- Points don’t expire: The points transferred to your Rapid Rewards account won’t expire as long as your card is open or you have flight-earning or partner-earning activity at least once every 24 months.

- Chase has a rule that they will automatically deny your card application if you have received 5 new cards in the past 24 months (aka “5/24 rule”). This means 5 cards from any bank – not just Chase.

Here is a very important piece of info:

- Normally, the Companion Pass is earned by flying 100 qualifying one-way flights or earning 110,000 qualifying points. Once you achieve either of those, you’d get the Companion Pass for the rest of the year in which you met those requirements, plus the next calendar year.

- With this offer for Californians, if you meet the normal requirements before the end of 2018 ”the regular Companion Pass qualifications will supersede the promotional Companion Pass, entitling the individual to Companion Pass through December 31, 2019.” SWEET!!!

I suggest you sign up now for a card. Make one purchase. Earn the Companion Pass through 12/31/18.

Look at your statement when it arrives in a month or so. When did the statement close? For example, let’s say it closed November 10, 2017. Time your spending so that you DO NOT meet the spending requirement that earns you the sign up bonus UNTIL the statement period in which the statement closes in January 2018.

Even more simply put: Don’t make your second purchase on the new card until January 1, 2018.

In this example, let’s say you got the Plus personal card that has a 40,000 sign up bonus if you spend $1,000 in the first three months the card is open. Do not cross the $1,000 in total charges in the life of this new card until you are in the period of the statement that closes in January 2018.

Once you meet the spending requirement, your bonus miles will hit your Southwest account. In this hypothetical example, the statement closing date is January 10, 2018. Your 40,000 bonus points plus at least a point per dollar spent on the new card will drop in January 2018. You are that much closer to getting a Companion Pass through 2019 – something another card bonus could help you attain sometime next year.

Another tip: Chase is very good about changing the statement closing date to whatever you want it to be. Four years ago when I got the Companion Pass, I wanted it ASAP. I asked Chase to change my statement closing date to January 2nd. Doing that gave me two full years, minus a day, of Companion Pass glory!

There is no waiving the annual fees of $69 or $99. Those amounts do NOT count toward the spending requirement.

This offer is only for Californian residents. Why? Southwest is starting to fly to Hawaii later next year.

You can find these cards under “Chip’s Favorite Credit Card Offers” at the top right side of this website. Click on “Travel Rewards Credit Cards”. Email me if you have any questions. Thank you for using my links to apply!