I am a land baron – kinda like The Donald but with a better coiffure. When a significant portion of my vast real estate portfolio became vacant (my furnished guest house), I decided to dabble in a little Airbnb.

I am a land baron – kinda like The Donald but with a better coiffure. When a significant portion of my vast real estate portfolio became vacant (my furnished guest house), I decided to dabble in a little Airbnb.

In case you are saying, “Air-what-the-what?” Airbnb.com is a website where people can list their home for rent and find places to rent – often short-term. People list anything from a single family house right down to a shared room in an apartment.

It means extra cash for an Airbnb host and often a less expensive alternative to a hotel for an Airbnb guest.

If you are new to Airbnb, use this link to sign up and we will both get $25 off our next stay in an Airbnb place. Not “our” stay, your stay and my stay – unless you wanna bunk up. You can pay for one night and I’ll pick up the other. I digress.

Nothing New Under The Sun

Renting out part of your home is not a new thing. In fact, you don’t even have to pay taxes on the income if you rent out your home for less than 15 days a year.

You might use that fortnight to test the Airbnb waters and pocket some tax-free cash.

Contrary to what you may have read, it is not illegal. Here is the chapter and verse from the IRS: “If you rent property that you also use as your home and you rent it less than 15 days during the tax year, do not include the rent you receive in your income and do not deduct rental expenses.”

This is often called “The Masters Exemption” because so many people rent out their homes during The Masters golf tournament. Renting one’s home to tourists was quite popular during the 1984 Summer Olympics in Los Angeles. With the world coming to LA, short-term housing was at a premium. Hotels were packed. General Motors ended up renting The Love Boat to house executives and top salesmen.

Landlord vs. Hotelier

My guest house was born in 1940s Los Angeles as a two-car garage. According to the permit, it was legally converted to a guest house in time for the 1984 Olympics.

Instead of playing landlord to another long-term tenant, I decided to try out Airbnb to see how I liked being a hotelier. Airbnb places usually rent furnished and only for days or weeks, therefore they fetch more than what one might get per day on a long-term or month-to-month tenant. But how much more?

For me, the answer came fast and easy: I got half again as much as I did with long-term tenants. What I’d normally rent long term for $1,000 brought in $1,500 via short-term Airbnb. That was with 100% occupancy. Those extra hundreds of dollars were nice but they came with a price: my time. I had to answer inquiries, make sure the place was clean and tidy, and coordinate turning over the various tenants.

Wanna Give It A Shot?

Being an Airbnb host is a way to turn that extra room into some extra cash. If you are thinking about becoming a host, these are the first steps I suggest.

- Sign up for an account. If you don’t have an account, click on this link to sign up and you will get $25 off your first trip – should you ever leave your home.

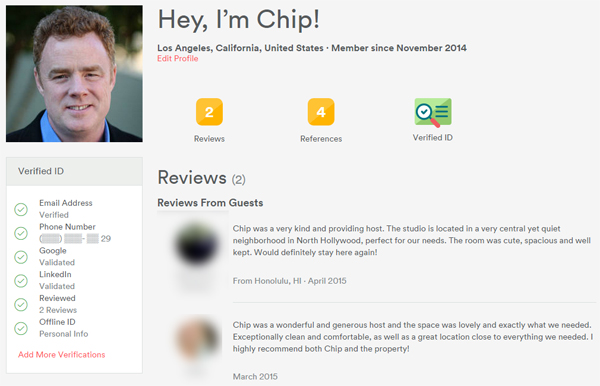

- Verify as much of your information as possible. Put your picture on there. Use the same email as the one you used on Facebook so you can link to that as well.

- There are “Reviews” and “Recommendations”. Get recommendations. I’ve been an old skool landlord for 13 years. I asked a few of my former tenants to write a recommendation and they did so happily. Not all landlords are slumlords! You can also get recommendations from your friends who are Airbnb members. Do anything that accentuates your status as an upright citizen.

- Price it low to get some stays and reviews from people who actually stay in your place. Search Airbnb for similar listings near you. This will give you an idea of what you should charge. After you get some nice reviews and recommendations, you may decide to charge more.

- Airbnb handles the transactions. The day after check in, Airbnb pays the host the money for the entire stay. This is not “under-the-table” money. You will receive a 1099 from Airbnb at the end of the year. I got my money in my bank account 2-3 days after stays started. If you do this for only 14 days, you will not have to pay tax on this income.

- Hosts pay a 3% service fee. Travelers pay a service fee of 6%-12%.

- Once your Airbnb account is up and running, I suggest you keep all communications inside Airbnb’s interface. This goes for whether you are host or a traveler. In case a problem arises, Airbnb will act as an arbitrator. They have the final say. They also have a $1,000,000 Host Guarantee will reimburse you for up to $1,000,000 in damage to your eligible property.

As I said, the IRS allows you to rent out your residence for 14 days and keep the proceeds tax-free. That could be hundreds or thousands of tax-free dollars.

Here’s a screenshot of what my Airbnb profile looks like. Notice all the different ways I verified my ID. I included the Reviews, but am far too modest to post the gushing References from my past long-term tenants.