My hobbies have always involved cards: baseball, poker and credit. Last week in my April Amex App-Aloosa, it took 20 minutes to apply for four American Express cards. I was approved for all of them.

My hobbies have always involved cards: baseball, poker and credit. Last week in my April Amex App-Aloosa, it took 20 minutes to apply for four American Express cards. I was approved for all of them.

This hobby isn’t for everyone. I like trying out different credit cards while marinating in their huge sign-up bonuses. I always pay the cards off in full so I never pay any interest – otherwise this would be a losing proposition.

Here’s how my April Amex App-Aloosa went down:

I got the Gold Delta SkyMiles personal and business cards, as well as the Starwood personal and business cards. I will get over 100,000 miles/points in bonuses once I meet the spending requirements. These cards have great perks.

Check out my thoughts on Starwood Points here and Delta SkyMiles here.

Click on Chip’s Favorite Credit Card Offers for up-to-date deals, terms, and conditions on these cards and more. Email me if you have any questions about which card might be right for your situation.

I opened up a clean browser window for each application and clicked on “In Private Browsing” in Internet Explorer. Google Chrome calls it “Incognito”. You may feel compelled to do this in a tuxedo while drinking something shaken not stirred.

The double-secret spy stuff makes you appear to the website as a first time caller. You don’t want cookies from previous visits possibly confusing your App-Aloosa. Cookies and martinis don’t mix.

The double-secret spy stuff makes you appear to the website as a first time caller. You don’t want cookies from previous visits possibly confusing your App-Aloosa. Cookies and martinis don’t mix.

FYI: If AmericanExpress.com recognizes you, it can be very difficult to find the card for which you are trying to apply.

I applied for the cards one after the other during the same afternoon. By doing this, it has been my experience that these will show up as only one hard-pull credit inquiry in my credit report, not four. Too many inquiries can lower your credit score and decrease your chance of getting approved.

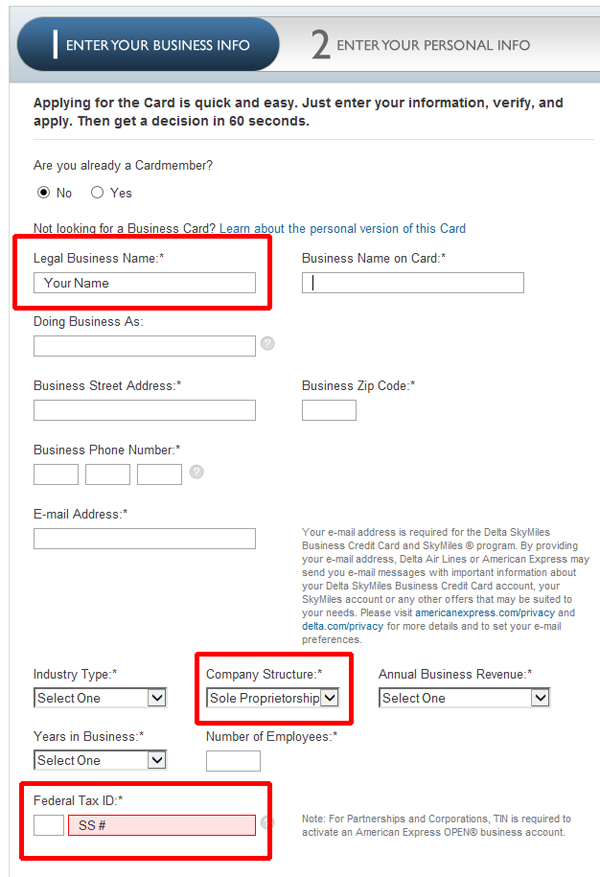

Remember, if you make money doing something, you can get a business card. You don’t have to work for a company, have a corporation or an LLC to get a business credit card. If you just said, “A what?” – don’t worry about it. In the application, for “Company Structure” choose Sole Proprietor. Put your name as the “Legal Business Name” and your social security number where it asks for “Federal Tax ID”. That’s what I did. See the application screen capture below.

Both business card applications asked me to call a number. They picked up right away. Each phone call took less than two minutes during which I was approved for each card.

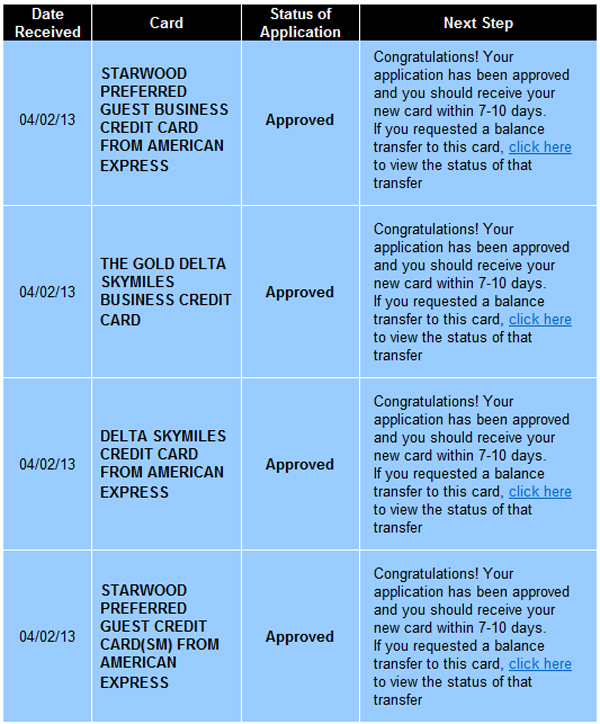

My personal cards were approved the next day. If you apply and are not instantly approved, check your application status here. Here’s my screen capture:

For business credit card applications – as a sole proprietor:

Check out Chip’s Favorite Credit Card Offers for up-to-date deals, terms, and conditions on these cards and more. Email me if you have any questions about which card might be right for your situation.

This content is not provided or commissioned by the company whose products are featured on this site. Any opinions, analyses, reviews or evaluations provided here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by the Advertiser. This site may be compensated through the Advertiser’s affiliate programs.