I was doing my taxes over the weekend. Like Mitt & Barack, I have some dividend income. I’m not quite at the $4.9 million in dividend income that Gov. Romney pulled down in 2010, but at least I’m in the game – and you can be too!

I was doing my taxes over the weekend. Like Mitt & Barack, I have some dividend income. I’m not quite at the $4.9 million in dividend income that Gov. Romney pulled down in 2010, but at least I’m in the game – and you can be too!

That’s the cool thing. YOU can buy stocks, collect some dividends and pay the less than ordinary federal income tax rate called “capital gains” be you the US President, a millionaire or a pauper!

If you are a pauper and enjoy ChipsMoneyTips at the public library computer, listen up. The 15% federal tax rate for qualified dividends drops to 0% if you are in the 10% or 15% ordinary income tax bracket.

If you feel like you can pick a stock or two, sign up for a free and insured brokerage account. The cost per trade is much less than what you would pay a stock broker: OptionsHouse ($3.95), Sharebuilder ($4-$6.95), TradeKing ($4.95), Zecco ($4.95), tradeMONSTER ($7.50), and E*Trade ($9.99).

Reader Anthony told me he did this a while back when he wanted to buy Apple. A few weeks ago, Apple announced a dividend program paying $2.65 per share, per quarter ($10.60/share/year). Since he bought a chunk of stock for $3.95, and it has appreciated nicely, I’ll have to ask him for some stock tips!

Reader Anthony told me he did this a while back when he wanted to buy Apple. A few weeks ago, Apple announced a dividend program paying $2.65 per share, per quarter ($10.60/share/year). Since he bought a chunk of stock for $3.95, and it has appreciated nicely, I’ll have to ask him for some stock tips!

But WHY the lower tax rates for investors like Willard, Obi, Oliver Twist and me? It’s to provide incentives for investors and to fund entrepreneurial endeavors. And, oh, I almost forgot, those dividends were already taxed at the corporate level. Wait, what?!!

The company already paid the corporate tax on the money that they eventually gave to its shareholders as dividends. As of April 1, 2012 we became the highest corporate tax rate in the world. U-S-A! U-S-A!!

It strikes me as odd that a company can write off as a business expense whatever they pay you in salary, but it’s not okay for them to write off whatever they pay you in dividends. Alas, THAT is a topic for another post.

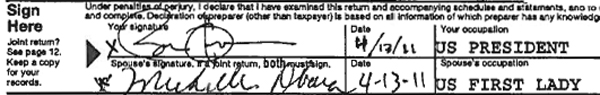

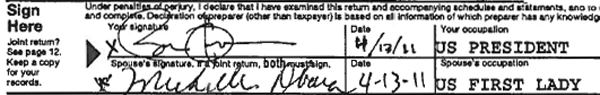

I got a kick out of seeing The Obamas’ tax return signature box. I especially like that they didn’t sign until April 12 and 13. That made me feel better. I can only assume because Michelle was the last one to sign, that made her the rotten egg and therefore the one to drive it to the post office.

I have accounts at ALL of the following Brokerage Houses, which are all SIPC insured.

Here are some of their current, great promotional offers:

- OptionsHouse – ($3.95/trade) – Free Kindle Fire – and/or – Up to $600 if open or move IRA there – or – 100 Commission-free trades – or – Free Dell Monitor – and – Get $150 if Refer-A-Friend

- Sharebuilder -($4.00/trade) – Get $50 for opening an account

- TradeKing – ($4.95/trade) – Open your TradeKing account now!

- Zecco – ($4.95/trade) – Open an account

- E*Trade – Trade free for 60 days and get up to $500 for cash, stocks or IRAs. “Credits for cash or securities will be made based on deposits of new funds or securities from external accounts made within 45 days of account open, as follows: $250,000 or more will receive $500; $100,000-$249,999 will receive $250; $50,000-$99,999 will receive $100; $25,000-$49,999 will receive $50.”

- tradeMONSTER – ($7.50/trade) – Trade Commission Free for 30 Days

- Fidelity – ($7.95/trade) – Has frequent flyer mile promotions on American, Delta, and United

- TDAmeritrade – ($9.99/trade) – Has a frequent flyer mile promotions on American as well as Starwood points for flights and hotels.

> SIPC is insurance, kind of like FDIC is for banks. Read more about SIPC.

> If you transfer stocks or an IRAs from one brokerage house to another, be sure to inquire about reimbursement for any transfer fees charged by the old brokerage house. The ACAT fee is usually about $75 and all the above brokerage houses should cover it.