Most know that when you donate to a charity, you can claim a tax deduction for being such a swell human being. That’s a fine “attaboy”!

Here’s another snazzy way to save on taxes by making a donation: Instead of donating cash, donate stock that you have owned for at least a year that has appreciated. By donating this way, you get to avoid paying the capital gains tax on the stock’s appreciation. You also get to write off the full value of the stock at the time of donation (not just what you paid for the stock many moons ago).

Let’s say you bought a bunch of NetFlix for $4,000. Now it is worth $10,000. If you sell that stock, you will have to pay capital gains tax on that $6,000 gain.

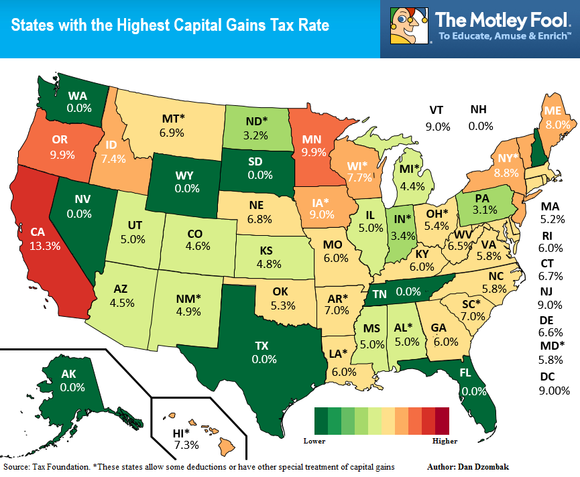

At a capital gains tax rate of 15%, you would have to pay the Feds $900. That’s just for the Feds. Some states and municipalities want a taste as well (see map below). My adopted home state of California has the highest capital gains tax rate in the country at a whopping 13.3%. That’d be another $798 for me.

In this example, I can avoid paying $1,698 in taxes by donating my appreciated stock directly to a charity.

Another way of looking at this: I donated something that cost me $4,000 but got a write off as if I paid $10,000 for it.

Some of you are saying, “But I love my Apple / Amazon / Buffalo Wild Wings stock!” That’s fine, donate it and buy some more. I assume your new stock purchase price will have a higher cost basis (purchase price) than your old soon-to-be-donated stock’s cost basis. At the end of the day, if you replace your donated stock with new shares, you will have the same amount of stock and a higher cost basis – which is good. All you are out is about $5-$10 for the new stock purchase.

What Is My Capital Gains Rate?

My example deals with a 15% capital gains tax rate. But it can be higher, or lower:

- If you’re in the 10% or 15% tax bracket for ordinary income, then your long-term capital gains rate is 0%.

- If you’re in the 25%, 28%, 33%, or 35% tax bracket, then your long-term capital gains rate is 15%.

- If you’re in the 39.6% tax bracket, then your long-term capital gains rate is 20%.

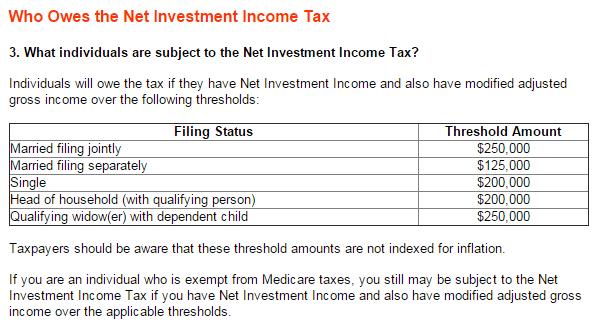

Plus another 3.8% Tax Savings

Donating stock will also avoid the Net Investment Income Tax of 3.8%. That’s the shiny new tax on folks who generally/roughly make over $200,000 adjusted gross income. It was created to help pay for Obamacare. Here’s the IRS’ breakdown of that:

How Do I Do This?

There are a couple ways to make this happen.

- Pick up the phone and tell your favorite charity, “I want to give the gift of appreciated stock!” You will quickly be routed to Carol in the Donation Department who will give you routing instructions so you can send them an ACH transfer of your shares. Your shares will go from your brokerage account to their account. You will receive a letter from the Carol’s charity thanking you for donating, with the dollar amount of the stock’s value when they received it so you can write it off.

- Another way to go is to donate to a Charitable Fund. Some brokerage houses have charitable funds (i.e. Fidelity Charitable, Schwab Charitable, TD Ameritrade Charitable, Vanguard Charitable). Ask your brokerage house if you can set up a charitable fund that will show up in your online account.

The cool thing about these Charitable Funds is that the fund is the charity. Once you donate stock to the Charitable Fund, your stock is liquidated. Now you have money to dish out any way you please to as many charities as you please. You get the tax deduction in the year you donate to the Charitable Fund, but you can give some now, and then some at a later date. It doesn’t have to be in the same year that you donate to the Charitable Fund.

Takeaway:

- Don’t sell stock so you have money to make a donation. Donate the stock and avoid taxes.

- If your stocks have lost value, don’t donate them. Sell the losers, take a capital loss (tax write-off), and then donate that cash to charities (another write-off).

If You Are Really Loaded

Individuals 70 ½ years old can make transfers from their IRA to a qualified charity up to $100,000 per individual per year. It is not included in income but there is also no deduction for the donation. This donation can be counted against required minimum distribution.