The holidays are upon us. Evidently Chase wants you to pay for Festivus with their plastic. They increased the bonuses on Sapphire Preferred & Freedom personal (not business) cards.

The bonuses can pay for a lot of Christmas presents, or even a free round trip to Europe!

If this is in your wheelhouse, at “Chip’s Favorite Credit Card Offers” at the top right side of this website, click Travel Rewards Credit Cards. Chase Sapphire Preferred is the 4th card down. For Chase Freedom, click Cash Back. It’s the 2nd card down. Email me if you have any questions.

Sapphire Preferred

Sapphire Preferred’s bonus is at an all-time high. It’s usually 40,000 Ultimate Rewards points. Now it is 50,000 + another 5,000 if you add an authorized user and make one purchase using that card. Remember, an authorized user can be anyone and you don’t have to give it to them. To get the bonus, you must spend $4,000 on purchases in the first 3 months your account is open. No annual fee the first year. No Foreign Transaction fees.

Besides the bonus points, you also get 1 point per dollar spent. So if you spend $4,000 and thereby meet the bonus’ spending requirement, you will have 59,000 points (4,000 + 50,000). 59,000 points is worth $590. Because it is technically a rebate, that money is tax-free should you decide to cash out.

Check out “11 Ways To Meet A Spending Requirement” for suggestions to make this very easy without wasting money.

Best Bang For Buck

With Sapphire you can transfer Ultimate Rewards points to loyalty programs at United, Southwest, British Airways, Korean Air, Singapore Air, Virgin Atlantic, Hyatt, Marriott, Ritz-Carlton and IHG properties. Transfers to United and Southwest are INSTANT. In the click of a mouse, 59,000 Ultimate Rewards points can become 59,000 United miles. Play around with combination of how to use your points.

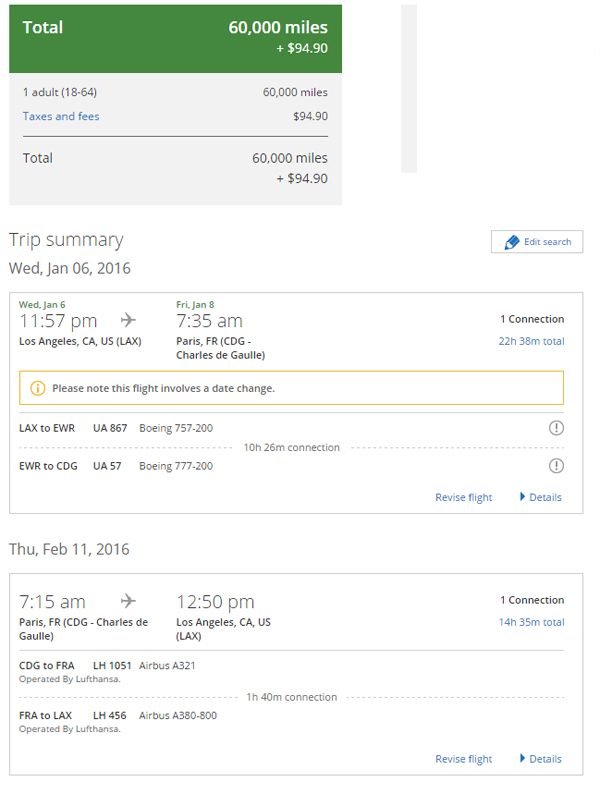

This Will Get You To Europe

60,000 United miles will fly you round trip from Los Angeles to London, Rome, Paris, etc. I punched in some random dates at United.com and voila! See screenshot below.

Remember, if you need more points but don’t want to waste money, check out “11 Ways To Meet A Spending Requirement”.

Freedom

Freedom’s bonus is $150 if you spend $500 in the first 3 months the card is open. Add an authorized user and make a purchase with that card for an extra $25. That is $175 for spending $500. Jeeeeeez. Like taking candy from a baby. You also get 1% cash back on every purchase, as well as 5% on rotating categories. The cash back actually come in the form of Ultimate Rewards points. You are not able to send points earned with your Freedom card to travel partners mentioned above.

Double Belly-Buster

But… you can transfer points earned with Freedom to Sapphire, and then send those to travel partners. If you happened to get both of these cards, you could send your 17,500 points earned on Freedom, over to Sapphire. Then you could shoot those Sapphire Ultimate Rewards points to the travel partners listed above. Pretty sweet.

Eligibility

You will not be able to get these sign up bonuses if you have received a bonus on them in the past 24 months or currently hold the card. Otherwise, go nuts!

Click on “Chip’s Favorite Credit Card Offers” at the top right side of this website. Once on that page, click Hotel, Motel, Holiday Inn… Chase Sapphire Preferred is the 4th card down. For Chase Freedom, click Cash Back. It’s the 5th card down. Email me if you have any questions.

Card Details:

Chase Sapphire Preferred® Card

- Earn 50,000 bonus points when you spend $4,000 on purchases in the first 3 months from account opening. That’s $625 in travel when you redeem through Chase Ultimate Rewards®

- 2X points on travel and dining at restaurants & 1 point per dollar spent on all other purchases

- Earn 5,000 bonus points after you add the first authorized user and make a purchase in the first 3 months from account opening

- $0 foreign transaction fees, plus chip-enabled for enhanced security and wider acceptance when used at a chip card reader

- 1:1 point transfer to leading frequent travel programs at full value — that means 1,000 Chase Ultimate Rewards points equal 1,000 partner miles/points

- Travel and shop with confidence with premium Travel and Purchase Protection Benefits, including Trip Cancellation/Trip Interruption Insurance, Auto Rental Collision Damage Waiver, Purchase Protection and more

- 24/7 direct access to dedicated customer service specialists

- Introductory Annual Fee of $0 the first year, then $95

Chase Freedom®

- Earn a $150 Bonus after you spend $500 on purchases in your first 3 months from account opening

- Earn a $25 Bonus after you add your first authorized user and make a purchase within this same 3-month period

- 0% Intro APR for 15 months on purchases and balance transfers. After the intro period, a variable APR of 13.99-22.99%

- Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate

- Enjoy new 5% categories every 3 months like Gas Stations, Restaurants, and Select Grocery Stores

- Unlimited 1% cash back on all other purchases — it’s automatic

- Cash Back rewards never expire as long as your account is open

- No annual fee