Do You Want $200?

Here’s an opportunity for some free money. You’ll get $200 tax free if you get the new Chase Freedom card, and spend $500 on...

Get NFL Sunday Ticket for Free

>>>>>>>>>>>>> Click HERE to get your NFL team's Visa card! <<<<<<<<<<<<<<

NFL Sunday Ticket costs $224.95. Here are 3 ways to get it free:

A) You could steal...

If Your Credit Blows, Let’s Fix That

If you are like me, you have done things in the past to screw up your credit. Like me, you can fix it –...

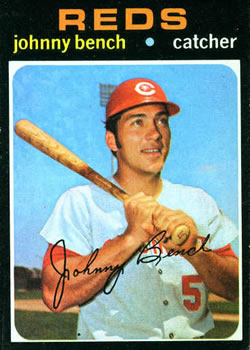

Results of My April “App-Aloosa”

My hobbies have always involved cards: baseball, poker and credit. Last week in my April Amex App-Aloosa, it took 20 minutes to apply for four...

Is a “Bereavement Fare” Fair?

Ben Franklin said, “Nothing can be said to be certain, except death and taxes.” April 15th is only 20 days away, so the latter...

Why I Called…

I usually reserve the use of my phone to win concert tickets, give my political opinions to robots, and to ask strangers if their...

Two Free Round-Trip Flights on Southwest AND AirTran

Just a quick mention about two current airline offers for TWO FREE FLIGHTS. Go getcha one now!

This is billed as "Two Free Flights" but...

Opting-Out for Dead People?

They keep sweetening the deal to get my dead dad to sign up for a United MileagePlus Explorer card. Well, it is a generous offer...

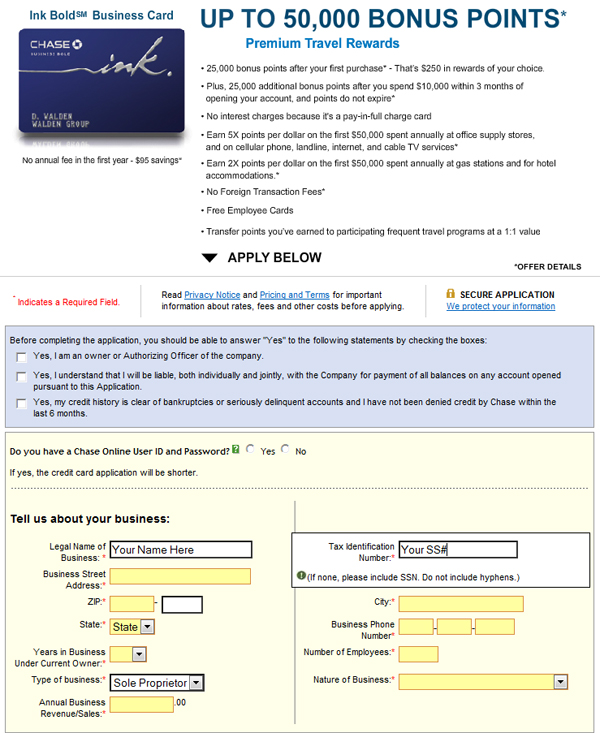

4 Ways Ink Don’t Stink

Chip's Money Tips Subscriber-Extraordinaire Jacko has a question:

"Can you recommend a decent rewards card that will allow me to float some payables for a...

TODAY is Small Business Saturday

Happy Guilt-Free Fun Spending Day! Today's the day to help yourself and small businesses. Take a minute to enroll all of your American Express cards...

Oh it’s on! ($mall Biz $aturday)

If you aren’t hip to this week’s Small Business Saturday awesome deal - read my post on it. Enrollment started in the wee small...

Just in Time for Festivus – UPDATE

My bromance with my Ink Bold card has never been stronger. Its terms were tweaked on 11/13/12, but I'm still smitten. Click on "Chip's Favorite...

Too Good To Be True? Nope. See for Yourself!

I don't suggest things unless I think they are a good deal, and more often than not, are things I have done myself.

Last week, I got...

Just in Time for Festivus

This offer has been updated.

Click on Chip’s Favorite Credit Card Offers for up-to-date deals, terms, and conditions on this card and more. Email me if...

How to Get Back Over-Payment $$

Reader Jesse heard the siren song of yellow bikini-clad Annie, and dabbled in a li’l Arbitrage! He wanted to know the best way to...

Debt Snowball is SnowBULL

I am SO clever with the word play. Reader Cary asked me a question related to my Debt Strategy Sessions. Cary wrote:

"I have some...

Nanner Passed Away Suddenly

A good friend of mine passed away suddenly last week (see video below). Just like when I flew to see my dying dad, I needed...

Update: Slate, as in “Clean”

Wipe your credit card interest slate clean. Pay 0% on Purchases and 0% on Balance Transfers for 15 months + No Transfer Fee!! Oh,...

United’s Awesomeness Expires Sunday Night

This offer has expired. Click on Chip’s Favorite Credit Card Offers for up-to-date deals, terms, and conditions on this card and more. Email me...

Reminder: Two Things To Do This Week

Get your $75 from loading up some Amex Prepaid cards. These are NOT credit cards, even though you will use them wherever Amex cards...

Last Day – Big Ben Tolls for Thee

Thursday, June 7th, is the last day to get the British Airways card worth up to 100,000 Avios Points. In plain plane English, half...

A Double-Dipper Tipper from The Chipper!

Ahhh… Classic Chinery. Here’s a quick and easy way to get 60,000 American Airlines frequent flyer miles. That’s enough for two free round trip...

Do This Before Cancelling Your Continental Card

My buddy Jack is still holding a Continental Airlines credit card. As you probably know, they merged with United. At some point, United will...