Did you like how I wrote “Yanks”? Wasn’t Meghan Markle beautiful? I digress.

Recently, the Wall Street Journal ran the story: Mike Meru Has $1 Million in Student Loans. How Did That Happen? He is one of 101 Americans with over $1 million in student loan debt. The article points out that 37 year old Mr. Meru pays about $1,600 a month, but that still falls short about $4,000 per month. At this pace he will owe over $2 million in two decades.

One must assume he didn’t study accounting.

The student loan discussion is percolating in my family. My nephew will be a high school senior in the fall, one year away from college. We don’t want him to pull a Meru. Should my nephew go to college?

Don’t get me wrong. I loved college! My Bachelor’s Degree is in Business Psychology. Yes, I am a man of letters. My folks wanted me to have some skin in the game. They thought it might motivate me. It did not. I have the transcripts to prove it. An added bonus: I had no concept of what it meant to pay back a student loan.

So I must pose the question that is also the title of my post: Are Student Loans “Child Abuse”? Is it okay to advise your (technically adult) child to take on all that debt?

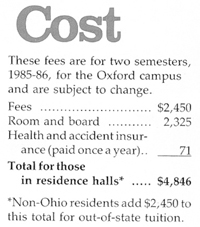

Luck for me, Miami University was affordable back then. Tuition, Room & Board, plus health and accident insurance for all four years combined came to $18,420. Believe it! Here are the cost breakdowns for my tuition as a freshman, sophomore, junior and senior.

Luck for me, Miami University was affordable back then. Tuition, Room & Board, plus health and accident insurance for all four years combined came to $18,420. Believe it! Here are the cost breakdowns for my tuition as a freshman, sophomore, junior and senior.

When I went to college, my folks had me sign on the dotted line for student loans. They ended up paying for about half – I assume that was the room and board portion. I’m glad I went and that I was able to pay back my loans quickly.

I was 18 but had no idea what paying back student loans really meant. It was a different time. Thankfully my student loan debt was a measly $7,500! Every month I dropped $96.15 in the mail to SLFC. I was out from under it in 7 years.

Before we saddle my nephew with debt, we need to make sure going to college is worth it for him. Should he take a year off to earn some money while he sees what life is like in the real world without a college degree?

I’m cherry picking from the Wall Street Journal article here. Mr. Meru said of his growing debt: “I just wouldn’t look. The only thing looking did was create stress.”

Yeah… I guess it would.

The article went on to say, “Mr. Meru then entered into a government-sponsored repayment plan based on income. He agreed to monthly payments at 10% of his discretionary income, defined as adjusted gross income minus 150% of the poverty level. Any balance remaining after 25 years is forgiven, effectively covered by taxpayers. The forgiven amount is then taxed as ordinary income.”

Why not just declare bankruptcy? Student loans cannot be discharged in bankruptcy.

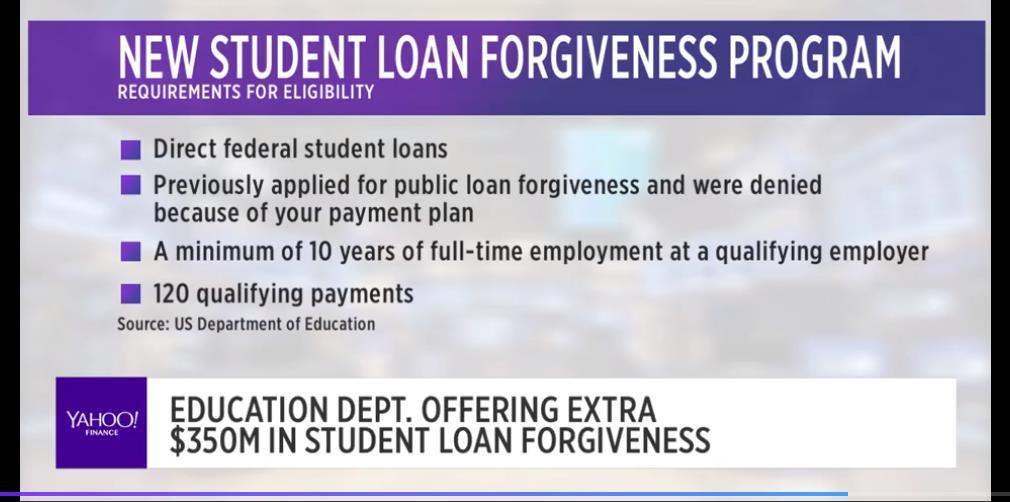

There is another program for student loan forgiveness. It has some hoops through which you must jump. But if it will work for you, it’s worth it. Check out more on that here.