Tax Day is Tuesday, April 17th this year. Some will get refunded a portion of the free loan they gave the government. Others will be scrambling at the 11th hour to come up with cash to pay The Man, man.

Whatever your situation, making your payment(s) via three IRS Approved websites can be very profitable! Yes, make money paying your taxes.

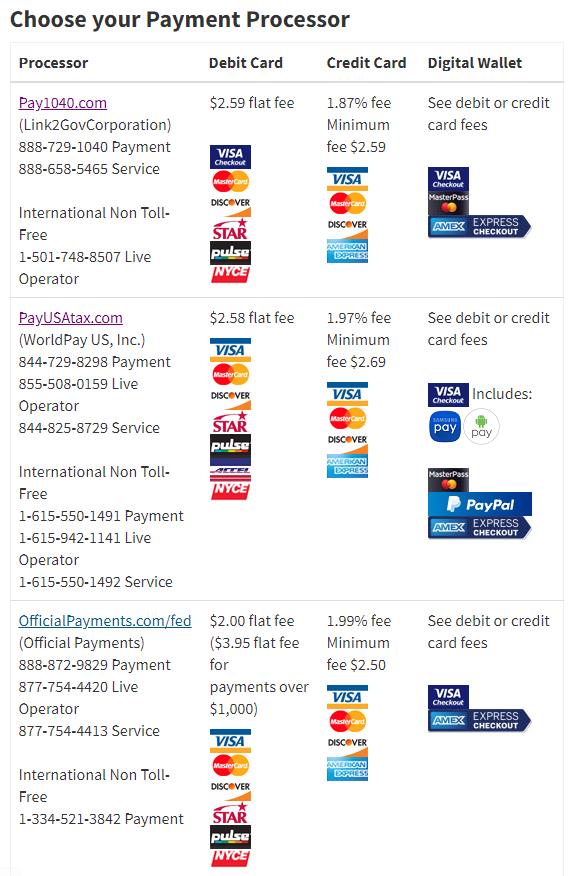

Pay1040, OfficialPayments and PayUSATax allow you to pay personal and business taxes by credit or debit card. All three accept Federal tax payments. OfficialPayments accepts State as well as Fed. You might think paying the fee to do this is a waste of money vs. writing a check. Pay1040 charges the least to use a credit card (1.87%). For every $1,000 paid in taxes, they take another $18.70 scoop in convenience fees.

But… here are 5 Ways using a credit card can be a GOOD (and profitable) idea:

- Paying taxes this way is not a cash advance. So if you are tapped out, but know you are going to have money to cover it later, you could slap it on a card that has a 0% introductory interest rate up to 18 months. Then pay the card off when you have the cash. Consider Citi Simplicity (18 months), Chase Slate (15 months), Chase Freedom (15 months), Wells Fargo Platinum (15 months), Citi ThankYou Preferred (15 months), American Express Blue Cash Everyday (15 months) and Discover it (14 months).

At the top right side of this site, under “Chip’s Favorite Credit Card Offer$” click “O% APR Credit Cards” for up-to-date info on these cards. Email me any questions. - If you have a credit card that pays you 2% cash back (Citi DoubleCash & Capital One Spark Business), you’d actually profit $1.30 per $1,000 paid. Under “Chip’s Favorite Credit Card Offer$” click “Cash Back Credit Cards”

- Using a card might be worth it for the convenience and knowing the payment got there. The IRS considers it paid when you charge the payment.

- You can make partial payments on more than one card. This is handy in case you have different airline, hotel and rewards cards. This way you could top off those accounts to get to the next level for a free flights, hotel stays, and what-have-you. Delta and Alaska will give new cardmembers 30,000 bonus miles if you spend $1,000 on their card in the first 3 months. Southwest has a 40,000 mile bonus if you spend $1,000 in the first 3 months. United has a 40,000 mile bonus if spend $2,000 and American has a 50,000 bonus if you spend $2,500 – both in first 3 months the card is open. You could rack up some nice bonus mileage for an $18.70 fee paying $1,000 in taxes. Under “Chip’s Favorite Credit Card Offer$” click “Airline Credit Cards”

- You can pay someone else’s taxes with your card. Maybe you need to meet a big spending requirement to get a sweet, tax-free credit card bonus. Some of my personal favorites: Chase Sapphire, Ink Bold, and Ink Plus come to mind. With those cards, it would be worth paying someone’s taxes + the convenience fee. They write you a check for what they owed the IRS. You eat the $18.70 convenience fee per $1,000 in tax.

Look under “Chip’s Favorite Credit Card Offer$” at the top right side of this website for up-to-date deals, terms, and conditions on these cards and more. Email me if you have any questions about which card might be right for your situation.

Thank you for clicking on links under “Chip’s Favorite Credit Card Offer$” at the top right side of this website for up-to-date deals, terms, and conditions on these cards and more. I appreciate it! Not only will that ensure you get the correct offer, but we may get a referral credit from approvals. That support helps keep the 1s and 0s spinning around cyberspace bringing great Chip’s Money Tips to you!! Many graciases. Email me if you have any questions about which card might be right for your situation.

Thank you for clicking on links under “Chip’s Favorite Credit Card Offer$” at the top right side of this website for up-to-date deals, terms, and conditions on these cards and more. I appreciate it! Not only will that ensure you get the correct offer, but we may get a referral credit from approvals. That support helps keep the 1s and 0s spinning around cyberspace bringing great Chip’s Money Tips to you!! Many graciases. Email me if you have any questions about which card might be right for your situation.