Move to California! Our politicians have come up with a way to let the Feds help provide money for books and living expenses for low-income college students. It’s also a HUGE win for you.

Move to California! Our politicians have come up with a way to let the Feds help provide money for books and living expenses for low-income college students. It’s also a HUGE win for you.

Individuals or companies that donate to California’s College Access Tax Credit (CATC) Fund in 2015 will get a California tax CREDIT of 55% of their contribution. This is not a “write-off”. This is a mucho bettero, full on state “tax credit”. Take that off what you’d owe in California taxes.

So, if you donate $1,000 you reduce the amount of tax you owe California by 55% (in this case, $550). You can also deduct the $1,000 on your federal return as an itemized charitable deduction. If your federal tax rate is 25%, your federal write-off would be $250.

Drumroll… in this scenario, you donate $1,000 and get $800 ($550+ $250) in tax savings. It cost you $200 to donate $1,000.

I know, I know. The focus isn’t supposed to be receiving money when you are making generous donations. This tax credit affords you the opportunity to donate even more than you normally would, because you are getting a lot of it back!

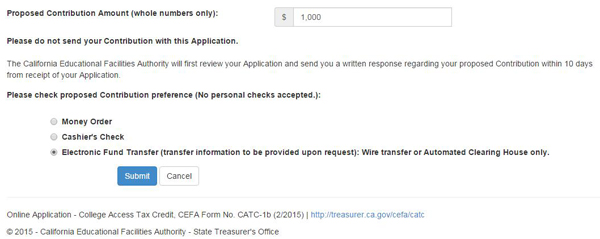

You have to apply here to be approved to make the contribution. You have until 5pm on January 4, 2016.

Here is the nitty-gritty on this program. If this sounds vaguely familiar, there was an issue with 2014 donors not being allowed to use the entire state tax credit to reduce their tax below tentative minimum tax (not to be confused with Federal Alternative Minimum Tax). Read about that issue here. Thankfully, that was fixed (here).