![]() If you’re going to purchase something you need, and someone is willing to pay you tax-free cash for doing so – I say let them!

If you’re going to purchase something you need, and someone is willing to pay you tax-free cash for doing so – I say let them!

Check out these cash back cards. Right now, Chase and Citi sweetened the deal with $100 bonuses!

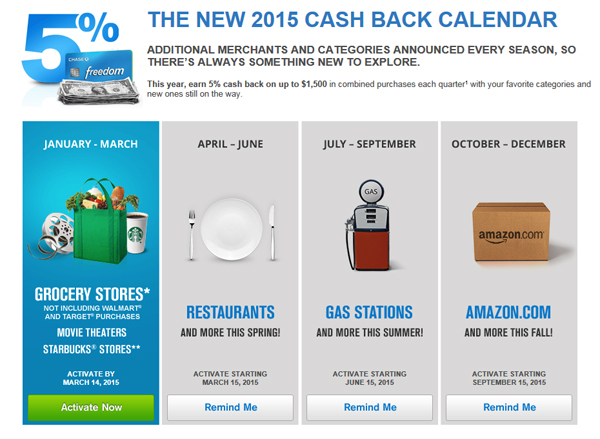

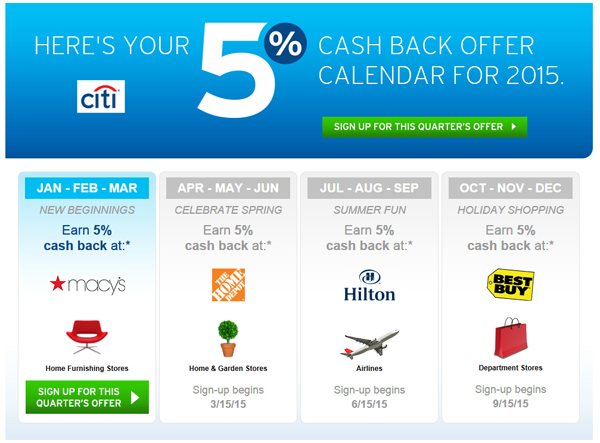

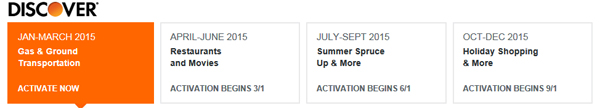

Here’s the scoop: Chase, Citi and Discover have credit cards that never have an annual fee and always give 5% cash back in certain categories. The categories change every three months. We can use these cards to get up to $900 cash back every year – without changing our spending habits. That cash back money is tax free. It adds up!

Instead of using cash, use these cards, get 5% cash back, and then pay off your bill with the cash you were going to spend in the first place.

Click on “Chip’s Favorite Credit Card Offers” at the top right side of this website for up-to-date deals, terms, and conditions on these cards and more. Email me if you have any questions about which card might be right for your situation.

Here are the new categories:

Chase Freedom® Visa – $100 Cash Back Bonus – Through September 30th, you can still earn 5% cash back on up to $1,500 in purchases in the following categories: Gas stations & Kohl’s. You might use your Chase Freedom card now to load up on some gift cards at those stores (earning 5% cash back now via Chase) for future purchases with those gift cards.

Chase Freedom® Visa – $100 Cash Back Bonus – Through September 30th, you can still earn 5% cash back on up to $1,500 in purchases in the following categories: Gas stations & Kohl’s. You might use your Chase Freedom card now to load up on some gift cards at those stores (earning 5% cash back now via Chase) for future purchases with those gift cards.

From October 1st – December 31st, you can earn 5% cash back on up to $1,500 in purchases at these merchants in these categories:

- Amazon

- Zappos

- Audible.com

- Diapers.com

You must enroll for the 5% cash back each quarter at ChaseBonus.com. It takes 20 seconds. They also offer to send you a text or email every quarter, reminding you to enroll for the 5% cash back as well as offering you a reminder for your Google, Yahoo, Outlook and iMac calendar. All other purchases earn 1% cash back.

Right now Chase Freedom Visa has a promotion that will give you $100 Bonus Cash Back on top of everything, if you apply for the card and spend just $500 in your first three months. Check out this easy way to meet the spending requirement.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Citi® Dividend Platinum Select® Visa® Card – $100 Cash Back – Through September 30th, you can still earn 5% cash back, up to $300 per year in these categories: Airlines & Hilton.

Citi® Dividend Platinum Select® Visa® Card – $100 Cash Back – Through September 30th, you can still earn 5% cash back, up to $300 per year in these categories: Airlines & Hilton.

From October 1st – December 31st, the 5% cash back categories are:

- Best Buy

- Department stores

To enroll, log into your account online and click on the 5% cash back offer or call 1-800-231-0891.

Citi does not limit you to 5% on $1,500 spent in the categories per quarter (or $75 cash back per quarter) like Chase Freedom and Discover it. Citi let’s you go nuts! Conceivably, you could spend $6K today in this quarter’s categories, collect $300 cash back, and then put the Citi card in the drawer until January. All other purchases earn 1% cash back.

Right now Citi® Dividend Platinum Select® Visa® Card has a promotion that will give you $100 Bonus Cash Back on top of everything, if you apply for the card and spend just $500 in your first three months. Check out this easy way to meet the spending requirement.

This is not a typo. Chase and Citi have similar promotions. If you get both cards and both $100 bonuses, well, you do the math.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Discover it® Card – Through September 30th, you can still earn 5% cash back on up to $1,500 in purchases in these categories: Home Improvement stores, Department stores & Amazon.com.

Discover it® Card – Through September 30th, you can still earn 5% cash back on up to $1,500 in purchases in these categories: Home Improvement stores, Department stores & Amazon.com.

From October 1st – December 31st, you can earn 5% cash back on up to $1,500 in purchases in this category:

- Amazon.com

- Department Stores

- Clothing Stores

You must Log In to your account online to enroll in the 5% cash back rewards each quarter. Do it now. It’s quick and easy!

Want more? Check out my video post about how you can collect Cash & Prizes with Cards!

If you are ready to pull the trigger, click on “Chip’s Favorite Credit Card Offers” at the top right side of this website for up-to-date deals, terms, and conditions on these cards and more.

I personally have and use all three of these cards. Thank you for clicking on the referral links in this post. I appreciate it! Not only will that ensure you get the correct offer, but we may get a referral credit from approvals. That support helps keep the 1s and 0s spinning around cyberspace bringing great Chip’s Money Tips to you!!

Click on “Chip’s Favorite Credit Card Offers” at the top right side of this website for up-to-date deals, terms, and conditions on these cards and more.

This content is not provided or commissioned by the company whose products are featured on this site. Any opinions, analyses, reviews or evaluations provided here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by the Advertiser. This site may be compensated through the Advertiser’s affiliate programs.

Hey Chip,

Bank of America credit cards also have those 5% cash back features that change each quarter.

Hi Joe,

Thanks for bringing that up. Bank of America’s credit card that has 5% cash back caps the amount on which you are able to get that 5%, at $500 per quarter. That is 1/3 of what the above cards allow.

I’m also not a fan of the BofA World Points redemption program – unless something has changed since I delved into WorldPoints back in March. Let’s say you spend $500 on a 5% category. At the end of the day you have 2,500 WorldPoints. Redeem them for cash and you will get a $12.50 check. Suddenly your 5% is only 2.5%. You do not start getting a penny for every point until you start redeeming 25,000 points for $250.

So if folks, are looking to get into the 5% cash back card thing, I recommend the Chase Freedom and Discover More which have caps of $1,500. Citi Dividend only has an annual cap, and that is $6,000. I do not recommend the BofA card when you can get better deals on these other cards.

How do you buy gift cards at restaurants and gas stations? Doesn’t it bind you to make purchases there?

I am assuming you can buy gift cards for say Amazon at a gas station. Does that count- if it’s not a gas purchase but a purchase of a gift card at a gas station?

Please clarify and thanks for the excellent tips.

Hi Min,

Yes, buying a merchant specific gift card binds you to using it there. Not that there’s anything wrong with that.

If you have a restaurant that you frequent, use the credit card that lists “restaurants” in the 5% cash back category to purchase a gift card at that restaurant. Until October 1st, Chase Freedom is that card. The restaurant gift card purchase will get you 5% cash back on Chase Freedom. Then you will have the restaurant gift card to use at that restaurant at your leisure. You don’t have to jam it in before October 1st.

Regarding gas stations, I only tried to purchase that station’s gift cards but they said I had to pay with cash or debit. Boo! I did not see any other merchant gift cards at my gas stations. If your gas station sells gift cards other than their own, you can give it a shot and let us know if you get 5% cash back!

Hey Chip! (A.J.’s friend J.D. here. Wow, that sounds more secretive than it is.)

Anyway, I have loved your write-ups on credit cards. I searched and couldn’t find your take on the US Bank Cash+ card. Is it something to consider pairing with the Chase Freedom (since US Bank doesn’t have a Rewards Mall) . . . or would I be better off going with the Citi or Discover cards above instead? The choose-your-own categories thing from US Bank does some appealing, along with the 2% on grocery stores / gas. What do you think? Am I missing a hidden drawback?

Thanks, Chip!

Hi JD, The raven flies at midnight. Shenandoah. I repeat. Shenandoah. God Speed. Buuuuut seriously,.. I have the Chase, Citi and Discover 5% cashback cards. I do not have the US Bank card, so I have no first hand experience with it. Their website says one can “Apply in Branch Only” – which I have not done. Has anyone out there used the card ? How are the redemptions?