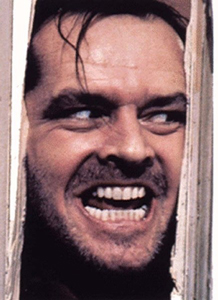

If you set up a Revocable Living Trust, make sure you choose a Trustee who will actually carry out your wishes. This sounds obvious, but some Trustees go rogue. Get a load of what a friend of mine went through. (Names have been changed to protect the innocent. Just like on Dragnet… or some other TV show that hasn’t been on the air for 40 years.)

If you set up a Revocable Living Trust, make sure you choose a Trustee who will actually carry out your wishes. This sounds obvious, but some Trustees go rogue. Get a load of what a friend of mine went through. (Names have been changed to protect the innocent. Just like on Dragnet… or some other TV show that hasn’t been on the air for 40 years.)

Joe’s aunt (Auntie Jane) had a Revocable Living Trust. As you know from a recent post, she set this up so her assets would avoid Probate completely, passing easily, and tax-free to the beneficiaries she named in her Trust.

Auntie Jane had no husband or children. 20 years ago, she named Joe’s cousin Biff as the Successor Trustee – the person in charge after she died. Biff would tidy up her affairs and disburse the inheritance to the beneficiaries. Auntie Jane passed away.

Her Trust clearly stated that “only non-beneficiary Trustees may be compensated.” Because Biff was a beneficiary, he would not get paid for tidying up her affairs. This is common. Most family members who are given the position of Trustee think of it as an honor and/or a duty.

Well… Biff didn’t like that idea, so he hired an attorney on the Trust’s dime to “advise” him. The result: Biff started charging the Trust $65 an hour for his time, ultimately paying himself $20,000. When confronted about this he simply said, “Sue me.” Hmm, sounds like Biff’s attorney was trolling for billable hours.

In addition to things like charging the Trust for the recurring “three-hour trip to the post office = $195”, Biff also let Auntie Jane’s money languish at a rate 40 times less than what he could have gotten at an FDIC insured online bank like EverBank.

Ultimately, Joe and the other beneficiaries decided it would be too expensive to take Biff to court. Biff got his equal share as a beneficiary plus $20,000 for administering his aunt’s Trust, against his aunt’s wishes.

Knucklehead Biff got a surprise at tax time when he found out he had to pay tax on that $20K as ordinary income. If he had left the $20K in the Trust for equal tax-free disbursement, the increase in his share as a beneficiary would have just about equaled what he ended up with after paying taxes on his $65/hour boondoggle. All he gained was a lot of bad will.

Biff basically took money from the beneficiaries and paid it to the government as his income tax. What an idiot.

Tidying up affairs can be time consuming. I think it is okay to give something extra to the person who does that job.

If you want your Trustee to get compensated, bequeath that to him or her in your Trust so that it is not taxable. Make sure you choose a Trustee who follows through with your wishes.

Although I am lovely and talented, I am not an attorney. This is not legal advice. Consult your attorney with any questions. LegalZoom & Nolo can help. So can this free info.