In other words, bust your chops now. Make extra money while you are young and sock it away for when you aren’t.

Recently, a friend asked me about my saving and investment plans. One of my goals is to have my home and rental properties paid off when I turn 60. Then I could live off the fruits of years of planning and self-sacrifice as I enter Geezer-dom.

She asked me what I would do with the income. I said that it’s not what I would do – it’s what I wouldn’t have to do. I would not have to work. Sometimes I don’t feel like working now – and I’m only in my late 30s. By that I mean 40s. I doubt I’ll feel more spry in my 60s or 70s.

I Stumbled Out of the Blocks

As far as retirement accounts go, I had a 401(k) plan when I wore a suit for TheBankMart in Connecticut in my early 20s. TheBankMart matched whatever I contributed, to a certain amount. That was sweet, free money! If your employer matches contributions – take full advantage of that. It’s like getting a raise for saving.

When I heeded the Sirens’ song and left the bank for the stand-up circuit, I cashed out my 401(k), paid taxes on the money as if it were ordinary income at my job, plus the 10% penalty for withdrawing it before I was 59½ years old. I should not have done that. Oh to be 23 and filled with certainty, er um, the foolishness of youth.

I did not start a Traditional IRA until I was 30. At the time, I thought I’d started WAY too late. Little by little, it has added up. In the words of a Chinese philosopher, and the poster in my doctor’s office, “A journey of a thousand miles begins with a single step.”

If you don’t have extra money to sock away:

The annual gift tax exclusion is $14,000 for 2013. If someone intends to leave you an inheritance, maybe they start gifting it to you now. Then you turn around and invest it in a ROTH IRA before April 15th this year. Keep it up to $14K and no one has any tax consequences. You cannot contribute more to an IRA than your Adjusted Gross Income (AGI) or earned income – whichever is lower. So, if you had a tough year and report $2,000 AGI on your taxes, $2K is the most you can put in an IRA – even if your folks gave you $14K.

Here’s the scoop from the IRS:

Maximum contribution to a traditional or safe harbor 401(k) plan:

- The limit is $17,000 for 2012 and $17,500 for 2013.

- The limit is subject to cost-of-living increases after 2013.

- Catch-up contributions. A plan may permit participants who are age 50 or over at the end of the calendar year to make additional elective deferral contributions.

For 2012, the maximum you can contribute to all of your Traditional and Roth IRAs is the smaller of:

For 2013, the maximum you can contribute to all of your Traditional and Roth IRAs is the smaller of:

Here’s more IRA contribution info.

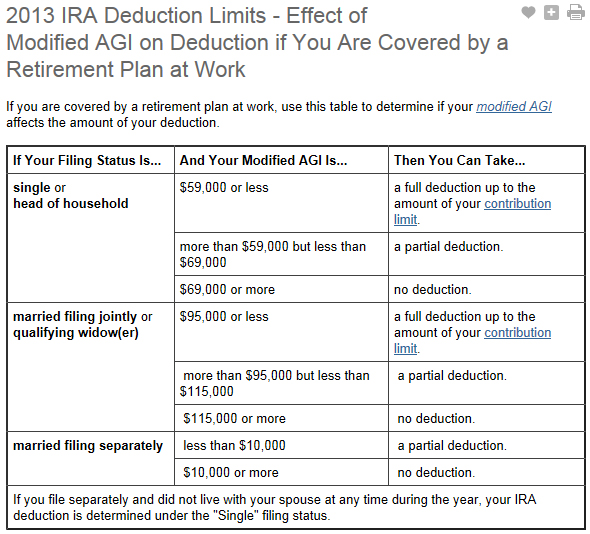

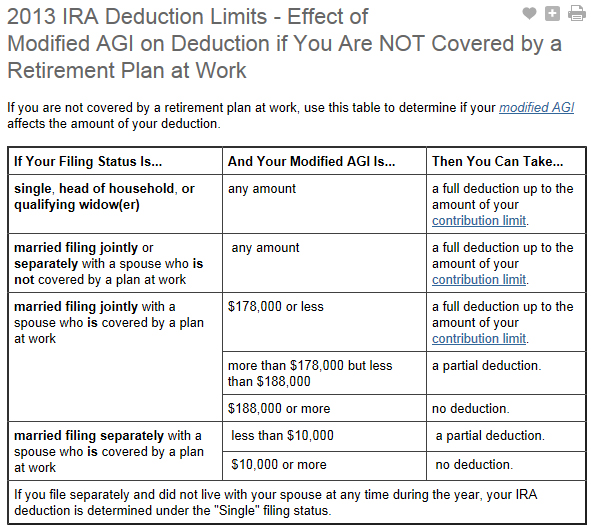

Already in a Pension Plan?

You can still sock away money into a retirement account as long as you do not exceed the income levels. See the links and the graphs they lead you to – below.

Here I am behind the wheel of my dad’s truck. Safety first. In the ’70s, that meant: Helmet – yes. Seat belt – no. And yes, that is the white gas cap behind the seat.

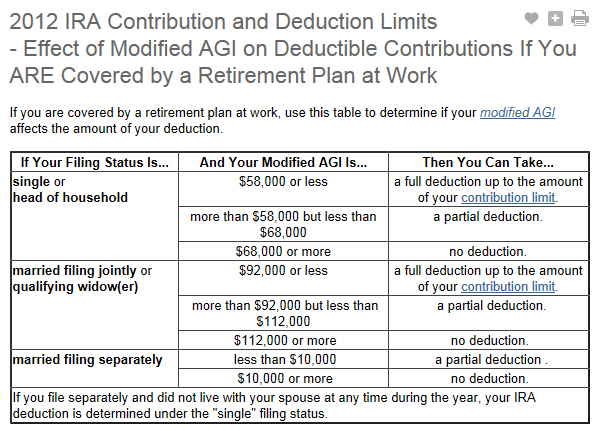

To operate links in screen capture below, click on this:

2012 IRA Contribution and Deduction Limits – If You ARE Covered by a Retirement Plan at Work

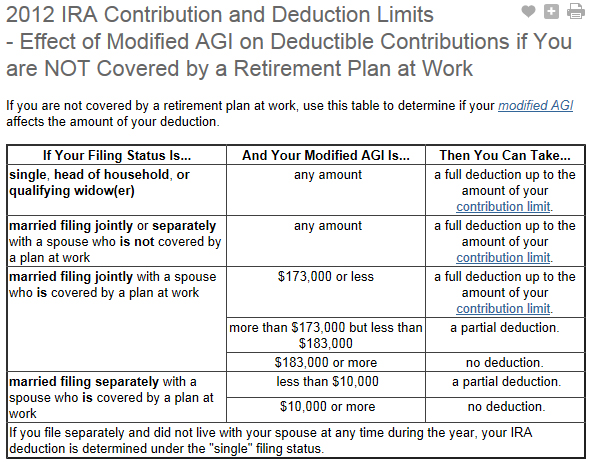

To operate links in screen capture below, click on this:

2012 IRA Contribution and Deduction Limits – If You Are NOT Covered by a Retirement Plan at Work

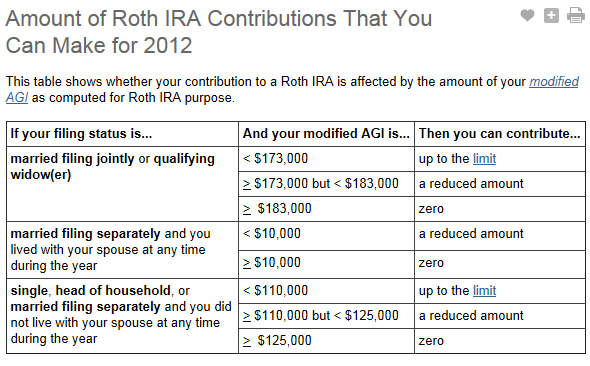

To operate links in screen capture below, click on this:

Amount of Roth IRA Contributions That You Can Make for 2012

To operate links in screen capture below, click on this:

2013 IRA Deduction Limits – If You Are Covered by a Retirement Plan at Work

To operate links in screen capture below, click on this:

2013 IRA Deduction Limits – If You Are NOT Covered by a Retirement Plan at Work

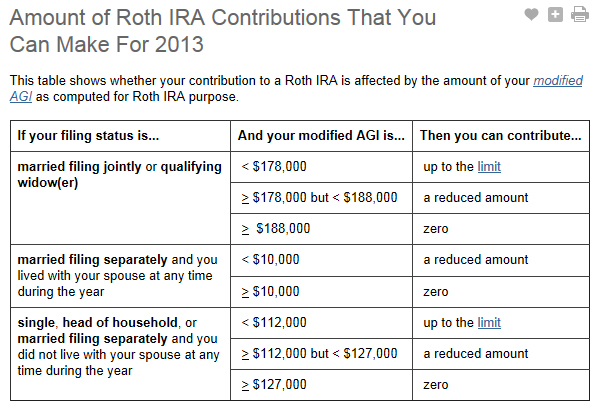

To operate links in screen capture below, click on this:

Amount of Roth IRA Contributions That You Can Make For 2013